The entire international Food and Agribusiness industry (F&A) is suffering the effects of the ongoing financial crisis. The global meat industry has been feeling the impact as consumers are cutting back on their food spending, financial institutions have tightened their credit lines, market confidence is lower and cross border F&A trade has declined. Players in the meat industry must overcome this temporarily negative medium-term outlook by focussing on their core business with clear cost control and processing efficiency. Since long-term demand drivers are not affected by the financial crisis, future winners will be those companies that take advantage of opportunities provided by the mediumterm market dynamics, improving their starting position when markets normalise.

The global financial crisis and its implications

Financial crisis deteriorating meat demand growth

Meat consumption has been affected in many countries worldwide and global per capita meat consumption in 2009 will decline compared to 2008. However, due to continuing population growth, meat demand in absolute volume terms will grow, although at a slower pace.In developed countries, where income represents the main driver of consumption growth, demand elasticity is generally low because meat is a basic good. However, as incomes come under pressure in 2009 due to the economic slowdown and consumer confidence reaches historically low levels, meat consumption is expected to decrease slightly. The value of the meat market in developed countries will decline even more as consumers will switch to lower-cost alternatives: from beef to pork and poultry, from steaks to sausages and from out-of-home to at-home consumption. For many developing countries positive GDP projections and population growth will result in further growth in meat demand albeit at a slower pace.

Declining meat demand is having a negative impact on sales and margins of meat companies. Many of these companies are already under pressure to recover from negative margins which were a result of the effects of the high feed costs during the second half of 2007 and the first half of 2008.

Investment in the industry reduced by decreased credit availability and market confidence

The financial crisis has decreased access to credit and capital markets. Credit from banks is still available but banks have become more selective in lending or increasing credit facilities. The reduction in available credit impacts the cost of borrowing and is leading to stricter terms. This increases the risk profile of many F&A players, including the meat industry. The overall situation has resulted in a reduction of production and trade, as well as difficulties in running or expanding existing operations.Low confidence in the market makes companies reluctant to take major strategic steps, although there are opportunities available. The reduced availability of capital, both equity and debt, has made it difficult for any one company to acquire another. This has resulted in a drop in M&A activity or new investments financed with external capital or by private equity houses. Low expectations for the meat industry in 2009 in combination with less available capital and credit has resulted in a sharp decline in new projects. For many years, investments for new projects in Russia were facilitated by government policies and the availability of capital from outside the F&A sectors. This resulted in a rapid modernisation and expansion of the domestic pork and poultry industries in Russia. However, today the meat industry is not able to invest in expected further growth of Russian supply, due to the country’s quickly increasing interest rates and lack of financial sponsors. In other emerging markets such as India, Indonesia and China, a limited number of new projects have been announced in the last few months.

Declining cross-border trade further impacted by exchange rate volatility

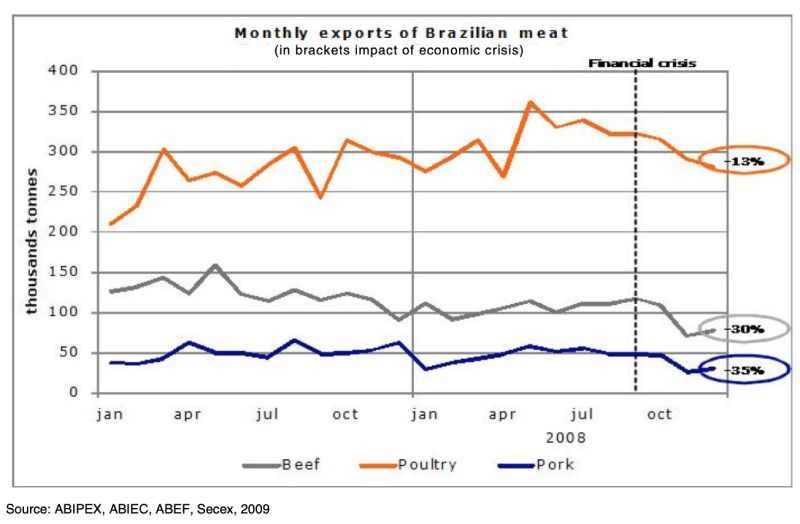

The reduced availability of trade financing together with slowing meat demand has had a strong impact on global trade. A very clear example is the development of exports from Brazil, the global powerhouse in meat trade (see Figure 1). While Brazil had been able to expand its total meat exports for many years, they have now dropped an average of 20 percent on a monthly basis (August vs. December 2008) compared to the pre-crisis months. The beef and pork industries have been hit hardest, with total export drops of 30 percent and 35 percent respectively, while the poultry industry has been facing a 13 percent drop in export demand. The impact of these figures is even bigger considering that Brazil’s competitive position has increased significantly compared to that of the USA, its main competitor, due to the appreciation of the US dollar.Figure 1: Monthly Exports of Brazilian Meat, Jan – Oct 2008

Competitive positions have been impacted by volatile exchange rates since the start of the financial crisis. The US dollar strengthened considerably vis-à-vis other currencies in the last months of 2008 but returned to 2008 lows in the first weeks of 2009, reviving the positive competitive position for US meat exporters. Australian producers in particular have seen a strong increase in world market prices, due to the weakening of the Australian dollar. The flip side of weakening currencies and the relative competitive position is that the price of inputs imported from the world market rise by the same percentage, thus undoing part of the competitive advantage.

The feed variable: refocus of attention on sourcing

Prior to the agricultural commodity boom, sourcing was not a major concern as commodity prices seemed fairly predictable and availability was hardly an issue. However, higher feed costs over the last one-and-half years have pressured working capital needs and severely reduced profit margins. The decline in commodity prices in the second half of 2008 relieved pressure on the working capital needs of companies; however, this did not improve margins. The expected rise in meat prices, which usually follows feed prices with some delay, did not occur due to the sudden drop in meat demand and declining cross-border trade. Some producers have forward contracts for feed purchases at the still higher price level. This will continue to reduce their margins for the coming months.Commodity prices will continue to be very volatile in the coming years. Commodity stock levels are still relatively low which implies that prices of agricultural commodities could rise again if the coming harvests do not fully meet the growing demand. This situation could occur faster than expected because farmers are forecasted to apply less fertiliser in the current crop and/or take less land into production.

The continuing high volatility will have a huge impact on the future position of the meat industry. Sourcing has re-entered the meat industry chain at full speed due to its strategic impact on profitability. Companies are shifting focus to the upstream and midstream segments of the value chain.

Outlook and key success factors of the winning players

The financial crisis has deteriorated market confidence, decreased credit availability, increased exchange rate volatility and lowered cross-border trade. All of this is having a negative effect on per capita meat consumption and deteriorating the investment climate for the short to medium term.However, due to continuing population growth in developing countries meat demand in absolute volume will continue to grow, albeit at a slower pace during the next few years. Moreover, long-term meat demand in volume will keep growing as other demand drivers, such as income growth and urbanization, are still in place resulting in a positive, long-term outlook for the global meat industry.

The deteriorating investment climate will challenge the meat value chain in the coming few years. Firstly, to attract direct capital in order to continue operations including possible restructurings in the current uncertain environment in which capital costs are higher than before; secondly, to have sufficient indirect working capital access when meat demand and/or commodity prices, begin to rise. This situation will be even worse if these two things happen simultaneously.

Winning companies will be those which perform well in the following three areas: good financials, operational excellence and demand focus. Companies with good financials have a strong balance sheet, positive cash flow and efficient cost control, which gives them possible access to direct and indirect capital and therefore the ability to face the difficulties of the financial crisis. Operational excellence is characterized by a lean-and-mean business model with optimal processing efficiency and flexible sourcing which is able to overcome commodity price volatility. The key aspect of demand focus is the company’s ability to react quickly to changes in demand. A broad customer portfolio and few preferred relationships with select customers will allow them to react quickly when meat demand recovers. Furthermore, even in the current difficult circumstances, restructuring, M&A and investment opportunities are available for such companies to strengthen their strategic position. These companies will be able to overcome the temporarily negative market developments, grasp the opportunities provided by the medium-term market dynamics and position themselves to be in the driver’s seat when markets normalize.