Summary

In this review, the author takes a critical look at trends in poultry meat and egg production in the Arab

World. FAO statistics on production and consumption for 2005 and predictions for 2015 are discussed

in the context of increased feed cost on the world market, national policy re. liberalized imports vs.

protection of local production and measures to control HPAI.

The author pleads for predictable government policy to encourage investment in land development to

support productive employment and poultry meat production based on locally grown feed.

Introduction

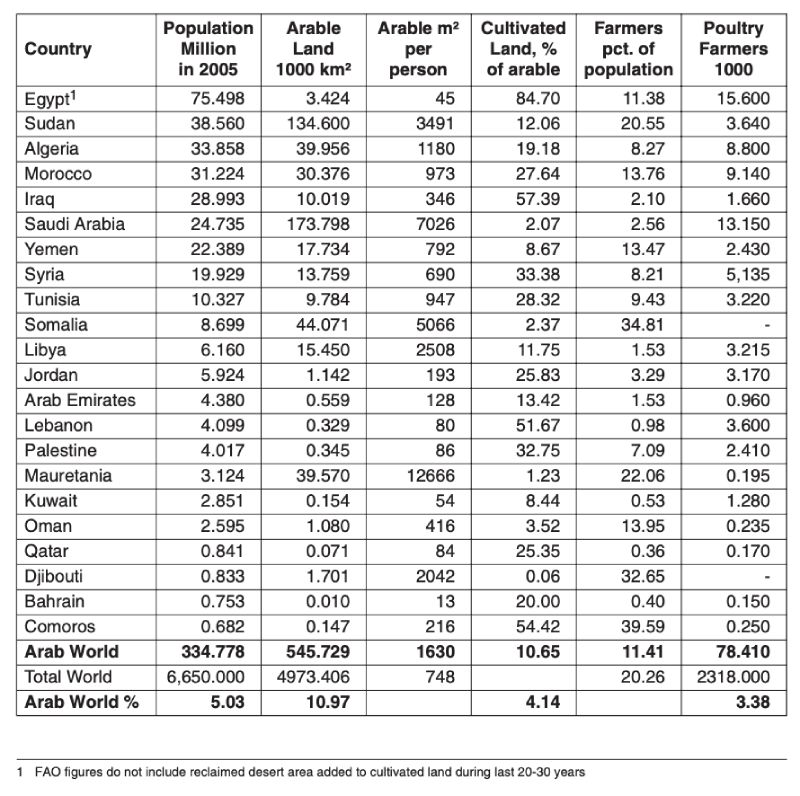

The Arab World consists of 22 independent countries spread over the south eastern part of Asia and all North Africa and most of the eastern part of Africa. Even though it covers vast areas of desert land, it enjoys huge natural resources such as petroleum, minerals, fish and fertile land; if properly managed and efficiently used for the benefit of its peoples, it will empower the Arab World, unified and cooperating, to produce all its needs of food. The total arable land area of the Arab World is 539 million hectares (only 39% of the total land area), representing 11% of the World (table 1). It is possible to reclaim and cultivate enough of this land and/or improve its productivity to self-satisfy the Arab World’s food needs.Table 1: Population and Land Use in the Arab World (Source: UN and FAO).

In 2005 the Arab World’s population reached 330 million, 23% of which live in Egypt and 31% in Algeria plus Morocco plus Sudan. The population of the Arab World represents 5% of the world population of 6.650 billion people. Only 36 million people or 10.4% of the population live from agriculture, compared to 20% of the world population who live from agriculture. Only about 78,000 people or 0.22% of the agricultural population are directly involved in poultry production in the Arab World, slightly more than the world average. This small number reflects the high degree of mechanization of the poultry industry with modern hatcheries, feed plants, processing plants and predominantly large production units. It should be noted that this figure does not include people employed in the supporting and complementary industries and the large number of rural families whose small poultry flocks do not contribute significantly to their income.

The poultry industry in the Arab world centers on the production of two edible products: table eggs and broiler meat. Many complementary industries revolve around the production of these two products: specialized breeding, grand parent and parent farming with dedicated hatcheries; cereal and oil plant production, processing of oil plants, vitamin and mineral production, production of finished feed; production of vaccines, medicinal products and disinfectants; slaughter plants including meat processing and further processing; table egg grading and processing; manufacturing of equipment, packaging materials, etc.. I will limit myself here to the production of table eggs and poultry meat.

Table 2: Per Capita Production of Eggs and Poultry Meat in the Arab World (Source: FAO)

Current and Predicted Production

Eggs

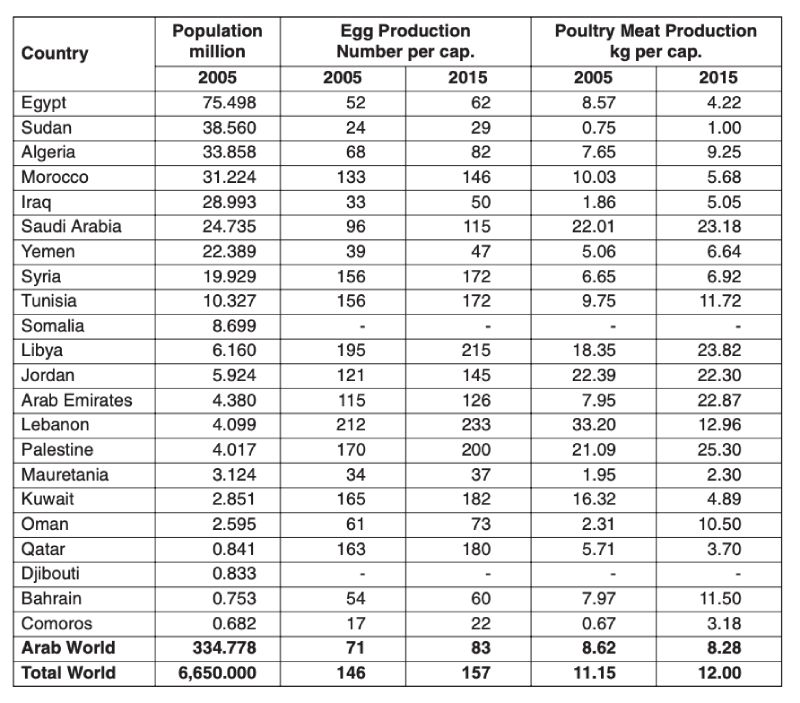

Table 2 shows the average per capita egg and poultry meat production in the Arab World in 2005 and predictions for individual countries for 2015. Total production in the Arab World reached 23.9 billion eggs in 2005, representing 2.5% of World production2. Per capita production ranged from 17 eggs in the Comoro Islands to 212 eggs in Lebanon. The average of 71 eggs in the Arab countries is less than half of the World average of 146 eggs.

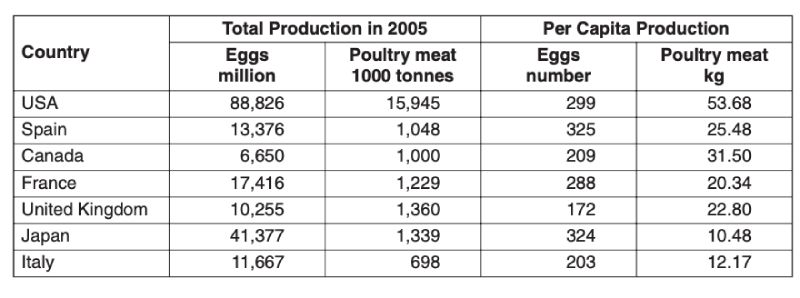

I expect that by year 2015 most of the Arab Countries will reach self-sufficiency with an average per capita consumption of 83 eggs. Production will increase by about 50% due to a 25% increase in population and an increase in per capita consumption. At that point I expect per capita consumption to range from 22 eggs in the Comoro Islands to 233 eggs in Lebanon. Per capita egg production and consumption in the Arab World is relatively low — about half of the World average and a third of some of the industrial countries (table 3).

Table 3: Per Capita Production of Eggs and Poultry Meat in Selected Industrial Countries

(Source: FAO)

Egg trading among countries in the Arab region is quite limited except between close neighbors. This is because consumers demand fresh eggs. We can safely assume that egg production will continue to increase in all Arab countries to meet the growing demand due to population growth and increased per capita consumption. I will not delve into theoretical scenarios of future exports and imports of table eggs from and to the Arab countries, but increasing imports of egg products from countries with lower production cost cannot be ruled out.

Poultry Meat

The issue of poultry meat production in the Arab countries drastically differs from that of table egg production. The cost of poultry meat production is very similar in all Arab countries, especially because they import their feed ingredients, parent stocks, vaccines, medicines and disinfectants. Their cost of producing poultry meat is about double that of countries producing their own feed ingredients. Therefore each of the Arab countries sets its own policy as to protecting its local poultry meat industry or opening up for imports.

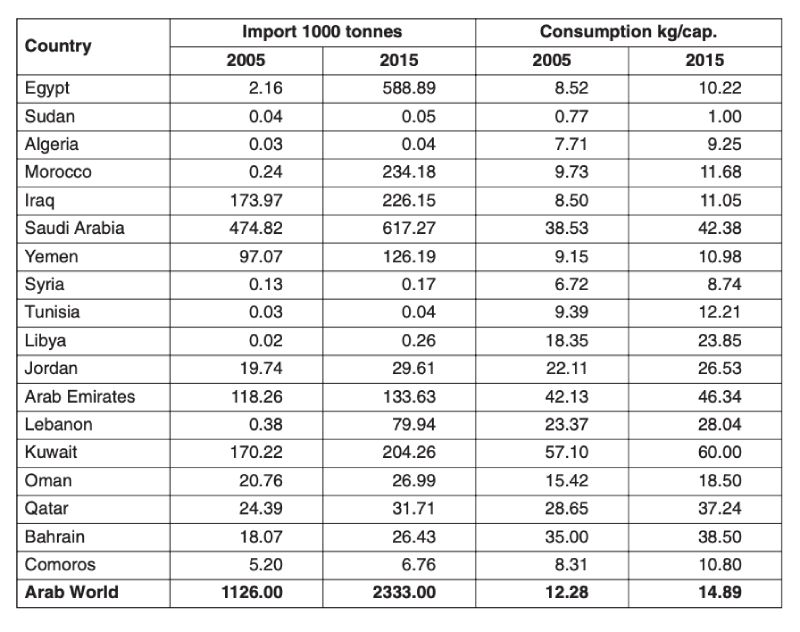

Table 4 shows that total imports in 2005 reached 1.126 million tons representing 31% of consumption. Most of the imports came to five countries: Kuwait, Saudi Arabia, Iraq, Arab Emirates and Yemen, where the policy facilitates imports and where frozen poultry meat is agreeable to consumers. Since most of the Arab countries have become members of the World Trade Organization (WTO),

Table 4: Imports of Poultry Meat and Per Capita Consumption in Arab Countries

(Source: FAO)

and since the cost of production of the major exporting countries such as Brazil, USA, Argentina, Thailand and others is half of that of the Arab countries, and since most Arab countries have become accustomed to buying frozen poultry meat, I can easily see the production of poultry meat dwindling and being replaced by imported frozen meat excepting the portion which is requested live or fresh. The latter will vary between 10 – 50% of the annual consumption in different countries, depending on consumer habits, their purchasing power and the protectionist policy of each of the Arab countries.

The total import volume of poultry meat into the Arab countries is predicted to double within the current 10-year period and represent 42% of consumption by 2015. Per capita consumption is predicted to increase from 12.3 kg to 14.9 kg by 2015, a modest increase compared to the current per capita consumption in major industrialized countries during 2005 (table 3). Worth noting is the vast difference in per capita consumption between individual Arab countries: from 0.8 kg in Sudan, 6.8 kg in Syria, 18 kg in Libya, 23 kg in Lebanon to as high as 57 kg in Kuwait – a world record, which puts the USA with 54 kg in second place.

While poultry meat consumption continues to increase, per capita production in the Arab World is expected to decline during the current decade due to increasing imports.

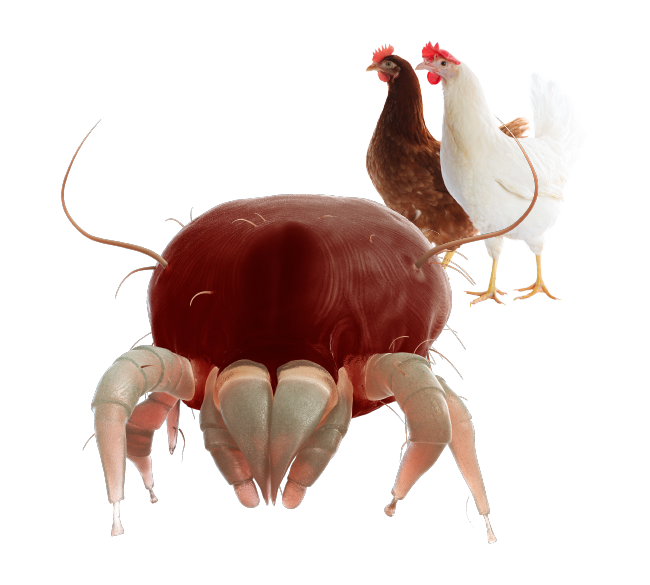

Repercussions of Avian Influenza in the Arab World

Since 1997 Highly Pathogenic Avian Influenza (HPAI) H5 and H7 has been plaguing the world. It has spread to more than 60 countries, killed millions of birds and caused 160 human fatalities. The importance of this disease and the noise it created lies in the possibility of its mutation to a degree which allows it to infect humans and eventually spread from human to human thus threatening to become pandemic. However, ten years after it started spreading, several measures have been taken to limit its spread and to minimize the probability of a pandemic actually developing.The use of inactivated AI vaccines in most countries that were exposed to the disease has proven its effectiveness in limiting its spread and in protecting the vaccinated flocks contrary to the predictions of many scientists especially human doctors. Other factors that helped were bio-security measures and separation of poultry rearing from pig rearing. Industrialized countries, recently with isolated outbreaks only, due to improved diagnostics and control measures, exercised stamping out policies within zones of 3 to 10 km radius from the infected farm with strict prevention of bird movement outside the zoned area. This policy worked because fair compensation was paid to farmers. Furthermore, rural poultry keeping is rare in such countries.

In underdeveloped or developing countries, where governments could not exercise the stamping out policy and were not prepared to compensate farmers, they had to allow vaccination. Commercial poultry benefited from this permission, but rural poultry remained unvaccinated and thus at risk. The disease remained, infecting rural poultry and peasants as well. Nevertheless, vaccination and biosecurity measures have proven effective in drastically reducing the spread of HPAI.

Low pathogenic avian influenza (LPAI) H9 spread in the Arab gulf countries (Iraq, Saudi Arabia, Yemen, Jordan, Syria and Lebanon) since the late 1990s. Governments of these countries permitted vaccination using inactivated H9 vaccines. This measure has limited its spread and economic losses of mortality and production. Luckily this LPAI stopped short of spreading to the African continent. Thus the Arab African countries remained free from this type of influenza.

Egypt was the only Arab country which was hit with HPAI H5N1 in early 2006. The disease has wiped out 40% of the poultry population in this country. It has changed the structure of the industry and the government’s perception of its viability and thus its need to protect it. This has led the industry leaders to be reluctant to modernize it and revive it. The basic reason for the spread of the disease in a very short period was the widespread rural free range keeping of chickens, ducks, turkeys and pigeons in all governorates as well as commercial poultry keeping in primitive poultry houses of all ages in very close proximities and lack of bio-security measures in such farms and areas.

The permission to use inactivated H5 vaccines, late as it was, has saved all commercial poultry since mid 2006. However, lack of vaccinating the rural poultry has kept the disease spreading in such areas and caused fifteen human casualties amongst rural women who kept poultry in their houses and who were always used to slaughtering any bird that shows any sign of disease before it dies. Even though no single human casualty appeared in commercial poultry keepers and workers, the Egyptian government decided to prevent live poultry markets but failed in implementing this directive. It is worth noting that 70% of poultry sales used to occur in live markets within cities or villages.

The Egyptian veterinary authority prevented movement of live birds unless samples were checked and found free from the virus. In spite of such a measure, the government kept chasing live market outlet owners. In the absence of sufficient slaughtering capacities, this measure interrupted regular production and increased prices. The government then decided to open up imports with no tariffs for nine consecutive months. After absence for 20 years, imported frozen chickens reappeared flooding the catering and retail markets.

Poultry industry leaders expressed their readiness to develop the industry by moving most poultry keeping to the desert areas, establishing modern slaughtering facilities and improving bio-security measures. However, the Egyptian government adamantly expressed its intention to reduce the import duty from 30% to 0% within three years. This has led the investors to shy away from investing in new facilities thus modernizing the industry. They are keenly aware of the competition from countries with

lower production cost such as Brazil, USA, Argentina and Thailand who produce their own feed and can increase their production to meet the added demand from several countries in the world.

Thus we see how the largest Arab country neglected to take appropriate measures to prevent the infection and spread of HPAI despite all the threats coming from the Far East since 1997, from the Middle East since 2002, from Italy since 2001 and from Turkey in the fall of 2005. The Egyptian government hesitated for a full month after the outbreak to allow the introduction and use of the inactivated vaccine, thus inflicting the worst avian influenza catastrophe in the Arabian world so far. Such losses besides the human casualties drove the government to remove the 30% import duty and allow imports of frozen poultry. The Egyptian poultry industry is valued at 2.6 billion dollars, and half a million people depend on it directly or indirectly. It has provided sufficient eggs and poultry meat for the Egyptian population for 20 years and was capable of exporting day-old chicks and hatching eggs worth 200 million dollars annually since 2002.

The Egyptian experience ought to be a lesson to the rest of the Arab world in order to take measures to prevent occurrence of the disease such as: impose bio-security – vaccinate against prevailing strains of AI – impose minimum distances between farms – stop free range rearing and impose housing such poultry – impose vaccination of rural poultry – extend free laboratory diagnostic services – prevent wild bird hunting – protect the local industry by appropriate import duties. Only such measures can save the poultry industries and entice investments in modern poultry farms, hatcheries and slaughter houses. Such measures will eventually create an industry capable of providing self-sufficient safe quantities of fresh table eggs and fresh poultry meat to its populations. Such measures will prevent shortages of such nutritious products to its populations in case AI invaded exporting countries such as Brazil or USA or others.

Open trade vs. protectionist policies

It has been an acceptable principle that an economic policy of any country must stem out of the interest of all sectors of societies. Normally, the private sector in free economies can take up the hardest tasks provided that the legislations are clear such that under normal conditions projects realize predictable profits. This principle ought to be applied on agricultural sectors as well including the poultry sectors.USA and Europe have long realized this principle. They have not only protected their farmers from unfair competition from the imported goods, but they have gone extra miles to subsidize their farmers thus allowing them to keep producing sufficient safe foods for their populations. The USA and Europe have recently resorted to their farmers with lucrative incentives to produce more crops that can generate renewable energy. The farm bill in the USA is revisited every five years to ensure fair compensation to farmers; US farm subsidies have exceeded $180 billion annually. Europe on the other hand established the “Common Agricultural Policy” 40 years ago. Its objectives are periodically reviewed. The present yearly subsidy for European farmers exceeds 50 billion Euros. Both USA and Europe stand firm on subsidizing their agriculture with the following justifications:

- Ensuring a stable supply of affordable and safe food for their populations.

- Providing a reasonable standard of living for their farmers, while allowing the agricultural industry to modernize and develop.

- Ensuring that farming could continue in all regions.

- Looking after the well-being of the rural societies.

- Improving the quality of food.

- Guaranteeing food safety.

- Ensuring that the environment is protected for future generations.

- Providing better animal health and welfare conditions.

Despite its huge size, farm subsidies in the USA and Europe do not exceed 0.5% of their GDP. The problem lies in the poor, underdeveloped and developing countries where GDP is low and governments lack the capability to subsidize. It is for this reason that I can see no real interest for such countries to rush and join WTO unless with their own favorable terms. On the other hand I cannot blame the industrialized countries for subsidizing agriculture, a practice which has so far resulted in innovation, productivity and technological advancements. I can blame the developing countries including the Arab countries for lack of protecting their farmers from competition of imported products including poultry meat. Such policies have so far resulted in worsening the economies of the Arab countries, in scaring investors and in increasing emigration of qualified citizens.

Balanced economies are the motto of developed countries. The USA has become the world’s largest exporter of corn and soybeans, and is self-sufficient in cotton, rice, meat and dairy products. Europe strives to keep farmers producing wheat, dairy products, olive oil and meats. Canada, a NAFTA member, imposes high import duty on dairy products and meat exceeding 200%, even on such imports from its partner USA. Japan prevents imports of red meat and rice from the USA even though it is a member of WTO. The WTO trade agreement on agriculture has never been agreed upon or signed up till now, 50 years after the inception of WTO, mainly due to the insistence of the industrialized countries to continue subsidizing their farmers and to upgrade their food quality standards.

The Arab countries must adopt trade agreements with other countries based on their own interest and not necessarily bound to WTO which might be crippling to its economies. There is a big difference between free trade and trade agreements on exchanging products with free will that serves the interests of agreeing partners. The Arab countries are generally underdeveloped with high cost of production and thus inability to export. Their only refuge to initiate and encourage investments is a protectionist policy which is fully realizable and agreeable to WTO rules.

Possibilities to develop the poultry industry in the Arab World

Developing table egg production in the Arab world is possible and realizable – despite higher production cost compared to some other countries – because the market requires fresh eggs. Therefore table egg production will continue to increase to meet demand via adopting cages and environmentally controlled houses. FAO import figures for the largest 13 Arab countries during the period 2000 to 2005 ranged between 383 million and 415 million eggs. Such figures represent only 1.95% of the production of these countries.On the other hand, meat production in the Arab countries depends on protecting this production from imports from countries whose cost of production is only 50% such as Brazil, USA, Argentina and Thailand. As shown in table 4, the Arab countries imported 1.126 million tons in 2005, representing 31% of total consumption. FAO import figures for the largest 13 Arab countries between 2000 and 2005 ranged from 465,000 tons to 770,000 tons or an increase of 66% in five years. This happened despite the fact that most of those countries impose import duties on poultry meat ranging between 20 and 70%. This means that the Arab countries are quite ready to increase their imports of frozen poultry meat at the expense of their local production.

This leads us to conclude that the development of the poultry meat industry in the Arab world depends on two options: increasing the import duties and/or reducing the cost of production. I believe that most Arab governments are not willing to adopt the protectionist policy. They will most probably reduce the import duties until fully eliminating them. This leaves us with the second option. Reduction of production cost depends on two factors:

(1) Improving productivity to levels achieved in the exporting countries. This includes reduction of mortality in broiler flocks to a yearly average below 5%, reduction of feed efficiency to below 1.7 and improving broiler parent productivity to over 135 broiler chicks per hen housed. Such achievements will reduce cost of broiler production by about 30%.

(2) Additional reduction in the cost of production can only come from producing corn and soybeans in the Arab countries at lower cost than the import prices. The cost to import these two feed items remained lower than the cost of producing them in any Arab country since 1960. Only during 2006 did their prices increase dramatically after the USA decided to encourage ethanol production from corn via extending financing of ethanol plants and subsidizing the price of ethanol. This prompted increased plantation of corn at the expense of soybeans and even wheat and barley. Thus prices of these commodities sky-rocketed during 2007.

Recent studies indicate that the USA will increase its use of corn for ethanol production from 75 to 150 million tons by 2015. Feed corn will stagnate at 190 million tons. This means that prices of corn, soybeans, wheat and barley will not drop until other countries such as Argentina, Brazil, Australia, Canada, Ukraine and others increase their production to face the shortage. This leads us to believe that certain Arab countries may be able to produce their needs of corn and soybeans at prices lower than the cost of importing them by the equivalent of their freight cost or more. This factor might bridge the gap of the cost of producing poultry meat in the Arab countries compared to the cost of importing it.

Sudan is the only Arab country that produces its needs of sorghum (replacing corn) and sesame plus peanuts (replacing soybeans). Their prices have recently become 50% lower than corn and soybeans. The arable area in Sudan is 135 million hectares while only 16 million hectares or 12% are cultivated. Sudan would be capable of producing and supplying the rest of the Arab world with its needs of grain and oil seeds for the production of eggs and poultry meat if and when the required infra-structure is in place and investment is encouraged. Syria and Iraq are two other Arab countries with great agricultural capabilities.

Freiji, M. (2008): The poultry industry in the Arab World. Proceedings 1st Mediterranean Poultry Summit of WPSA: Advances and Challenges in Poultry Science, May 7-10, Porto Carras, Chalkidiki, Greece.

FAO : FAOSTA – Agriculture/GLIPHA

OIE : Egypt HPAI H5N1 updated( Flutrackers.com)

EU : The Common Agriculture Policy – Agriculture and rural development europa.eu.int/comm./agriculture /index_en.htm

IcOne: Institute for International Trade Negotiations www.iconebrasil.org.br

USDA : 2007 Farm Bill – www.usda.gov/wps/portal

Zusammenfassung

Die Geflügelwirtschaft in der Arabischen Welt — Aktuelle Probleme und ZukunftsperspektivenAuf der Basis statistischer Daten, die von der FAO und den Vereinten Nationen veröffentlicht wurden, gibt Tabelle 1 einen Überblick über die aktuelle Situation in den Ländern der Arabischen Liga. Die Einwohnerzahl in der Gesamtregion beträgt etwa 5% der Weltbevölkerung, von der landwirtschaftlich nutzbaren Fläche wird weniger als die Hälfte tatsächlich genutzt. Ebenso wie die Einwohnerzahl und die landwirtschaftlich genutzte Fläche pro Einwohner variiert auch der Anteil in der Landwirtschaft und insbesondere in der Geflügelproduktion tätigen Menschen erheblich.

Es wird damit gerechnet, dass im Laufe dieses Jahrzehnts die Eierproduktion und der pro-Kopf Verbrauch an Eiern weiter steigen wird, während die Nachfrage nach Geflügelfleisch zunehmend durch billigere Importe aus Ländern mit Überschuss-produktion an Getreide bedient wird. Im Interesse verbesserter Selbstversorgung mit Lebensmitteln und Entwicklung des ländlichen Raums durch produktive Beschäftigung wird dafür plädiert, bisher ungenügend genutzte Landressourcen durch staatliche Förderung zu mobilisieren, um steigenden Weltmarktpreisen für Futtergetreide nachhaltig zu begegnen.