Abstract

The British egg industry is an excellent example of how an agricultural sector can innovate and embrace technology to become increasingly efficient, and to be reactive to consumer demand. It also employs the highest standards of food safety through the industry’s Lion Quality assurance scheme. The key influences on the industry include: continuing to meet supply/demand, with demand having led to the UK being the largest producer of free range eggs in the EU; ensuring that eggs are produced to the highest standards of food safety via the Lion Code of Practice; protecting and promoting high standards of animal welfare; ensuring animal health by protecting birds from disease challenge; protecting the environment and ensuring that international trade agreements recognise the UK’s high standards. The decision of the UK to leave the EU (“Brexit”) is going to have significant implications for individual businesses, as well as the country in general. For the egg industry, there will be both challenges and opportunities. Some of these include the need for continued access to labour; ensuring future trade agreements do not allow lower standard imports; avoiding an excessive legislative burden. The egg industry in the UK has just enjoyed its 12th continuous year of growth, which is a huge achievement. But it is always alert to

emerging issues and will take action to prevent them becoming a crisis.

Keywords

Egg Production, Lion Quality, Brexit

Introduction

The British egg industry is an excellent example of how an agricultural sector can innovate and embrace technology to become increasingly efficient, and to be reactive to consumer demand. It also employs the highest standards of food safety through the industry’s Lion Quality assurance scheme. How did the industry get to where it is today? Part of the answer probably lies in having been subject to the so-called ‘light’ regime of theEuropean Union’s Common Agriculture Policy, which has meant it has not received production support, leading to its focus on market orientation. Secondly, the ‘Salmonella in eggs’ crisis of the late 1980s and early 1990s when the then Junior Minister of Health stated that “‘sadly, most egg production in the UK is now infected with Salmonella” had a major impact. This sparked a crisis, with sales falling by more than 50% overnight with many businesses failing over the following months and years. Even during the 1990s eggs were blamed for any food poisoning case, guilty or not. Consumer confidence ebbed away and consumption continued to fall by up to 8% year on year.Realising that something had to be done, the forward-thinking members of the British Egg Industry Council undertook a major consumer research programme to identify how it could address falling sales and restore consumer confidence. Two major developments were put in place. The first was a complete revision of the Lion Code of Practice to: introduce compulsory vaccination of hens against Salmonella; to improve hygiene standards on farms and to ensure that rodents were properly controlled. The second was the first major advertising campaign for 20 years, with a £4 million television campaign promoting eggs and the British Lion mark.

The success of the scheme can be seen in the massive reduction in Salmonella in British laying flocks, as well as in humans. This has been recognised over the years by government, customers and consumers, and culminated last autumn in the British Food Standards Agency revising its long standing advice (effectively a health warning) on eggs to enable vulnerable groups (pregnant women, babies, and elderly people) to be able to eat runny Lion eggs again. This removes the final negative which surrounds eggs and we anticipate that this will lead to a further increase in egg consumption.

In 2017, egg consumption further increased to 197 eggs per capita, and self-sufficiency rose to 86%. Today, the industry has expanded to 40 million hens, making it the 5th largest producer in the EU.

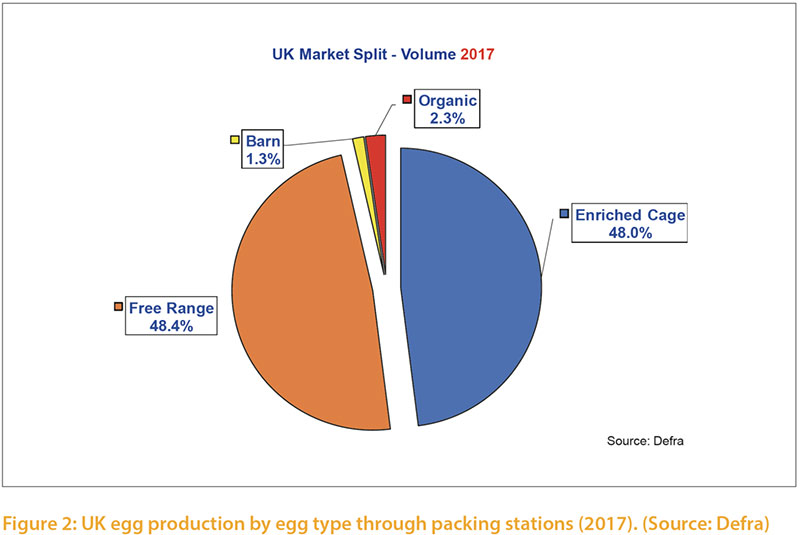

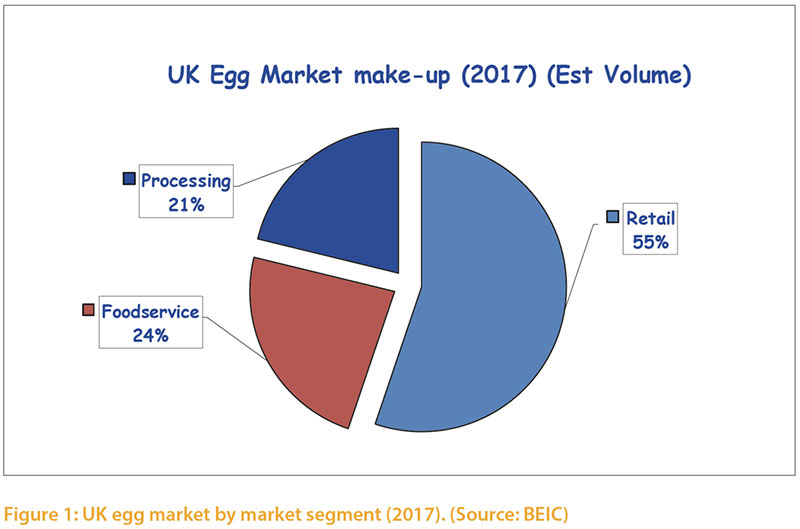

Figure 1 shows that 55% of eggs were sold at retail level, with a further 24% sold in shell at food service level. 21% are processed into various egg products. Figure 2 shows that the key production types are free range and enriched colony cages, with barn and organic making up the balance. In fact, of the 54 million free range hens in the EU, 22 million are to be found in the UK.

The key influences on the industry include: continuing to meet supply/demand (the market); ensuring that eggs are producedto the highest standards of food safety; protecting and promoting high standards of animal welfare; ensuring animal health by protecting birds from disease challenge; protecting the environment and ensuring that international trade agreements recognise the UK’s high standards.

The key influences on the industry include: continuing to meet supply/demand (the market); ensuring that eggs are producedto the highest standards of food safety; protecting and promoting high standards of animal welfare; ensuring animal health by protecting birds from disease challenge; protecting the environment and ensuring that international trade agreements recognise the UK’s high standards.The decision by the UK to leave the EU (Brexit) is going to have significant implications for individual businesses, as well as the country in general. For the egg industry, there will be both challenges and opportunities.

Some of these include;

- The need for continued access to labour

- Ensuring future trade agreements do not allow lower standard imports

- Avoiding an excessive legislative burden

Taking each in turn:

The need for continued access to labour.At present approximately 30% of workers in egg packing centres and on farms are from other EU member states. With UK unemployment at just 4.4% (December 2017), its lowest level for many years, this is already presenting particular challenges, with many companies struggling to retain staff due to competition from other sectors. Some non-UK nationals are returning home as the devaluation of Sterling has meant that it is no longer as financially attractive to work in the UK. As a result, the egg industry is seeking to retain existing and attract new staff by actively promoting career opportunities to UK workers at farm, packing and managerial level. The BEIC has also launched the Lion Training Passport, designed to both attract and retain staff. The industry remains of the view that government must allow businesses access to labour from outside the UK, year-round.Future trade agreements.

Successive UK governments have traditionally been supporters of free trade. However, with the threat of food price inflation following the fall in the value of Sterling, it could be attractive for the government to pursue a ‘cheap food’ policy to reverse this trend. We believe that a ‘fair trade’, rather than ‘free trade’, policy should be pursued to avoid damaging the UK industry from eggs/egg product imports which are produced to lower standards.Legislation.

The industry is proud of its high standards of animal welfare and environmental protection and does not wish to see these weakened following Brexit. In the past, UK governments have been guilty of ‘gold-plating’ legislation, by going beyond the minimum, which has led to competitiveness issues. We support further improvements to standards, but these must be based on research and sound science. In July 2017, the House of Lords Energy and Environment Sub-Committee inquiry into Brexit: (farm animal welfare) concluded; “Government will have to choose between 2 approaches post Brexit, either to become a low-tariff, competitive New Zealand-style economy, open to free trade in order to bring down food prices accepting that high-quality food and welfare standards will be difficult to enforce, or to continue to be a country that demands high welfare standards, high-quality food and looks to protect our hill farmers”.‘Cage-free’.

In 2016, most retailers and some food service companies announced that they would be moving to a ‘cage- free’ policy by 2025. This will be challenging for the industry, especially as it invested some £400m to comply with EU Council Directive 1999/74, which banned conventional cages across the EU from 2012. The question now being discussed is: ‘what will this look like? Will it be barn or free range?’Avian Influenza.

The threat of Avian Influenza is likely to remain in the near future, and, as such, serves to remind producers of the importance of implementing and maintaining high standards of biosecurity on farms. Just like many other European countries, the UK was affected by H5N8 Highly Pathogenic AI during winter 2017 through to spring 2018, albeit the UK saw fewer cases in poultry flocks.

The industry rose to the challenge by providing timely reminders of the importance of separating poultry flocks from wild birds. The requirement to house free range birds from December 2016 to April 2017 came with its challenges, especially the need for producers to provide additional management measures for their birds which had been used to ranging outside. Industry lobbying at EU level led to an amendment of the EU egg marketing legislation in November 2017 to allow free range hens to maintain their marketing status for up to 16 weeks (previously 12 weeks) should they be required to be housed under veterinary instruction. A working partnership between government and industry meant that cases were identified and dealt with quickly, which enabled infected farms to get back into production, as well as regaining ‘country freedom’ from HPAI status, therefore reopening international markets.

On the research front, industry funded a risk assessment supporting a review of the requirements for secondary cleansing and disinfection which was published in April 2017. This showed that complex equipment that does not come into contact with birds does not need to be dismantled to be cleansed and disinfected. What this meansin practice to a site infected by AI is that the time taken to conduct secondary cleansing and disinfection will be shorter and therefore the cost to the producer will be lower.

Northern Europe has seen findings of H5N6 HPAI in wild birds, rather than poultry flocks this winter, but the industry has not become complacent.

Although we are seeing occasional findings in wild birds, something we expect to see continue, the UK industry is well placed to deal with any threat to commercial poultry. The industry’s Lion Code of Practice has been amended to further improve biosecurity, this along, with the industry’s structure means that we are confident that any protective measures would be taken quickly and effectively to avoid major issues.

From the dark days of the Salmonella crisis to where it is today, the industry has made huge progress principally via the Lion Quality scheme and its high standards. It operates some of the most modern systems in the world, providing high quality, safe, affordable eggs and egg products to consumers. Consumer confidence has been restored via the Lion Quality mark and we have seen retail sales rise year on year by more than 5%. Encouragingly, this growth is being driven by younger consumers who see eggs as a natural healthy choice.

Backed by some innovative marketing campaigns using influencers from Olympic athletes such as gold-medal winner, Max Whitlock, to reality TV stars, the BEIC’s marketing campaigns have ensured that consumers now think of eggs as a ‘superfood’. Our recent campaigns have been more visual, increasingly using video to demonstrate how quick, easy and convenient creating an egg-based meal is.

The recently revised Food Standards Agency advice is also re-opening markets such as in Care Homes which had previously avoided runny eggs and the BEIC is now actively encouraging them to get eggs back on the menu.