Dr. E. Fallou Guèye

Vice-President, World’s Poultry Science Association (WPSA) & President, African Poultry Network of the WPSA (WPSA-APN), Dakar, Senegal.

Disclaimer: The views expressed in this publication are those of the author and do not necessarily reflect the views of the Food and Agriculture Organization of the United Nations. orcid.org/0000-0002-4537-4394 Corresponding author’s email: efgueye@gmail.comINTRODUCTION

The growth of the Africa’s human population, which is expected to increase from 1,394 million in 2021 to 2,485 million in 2050 (United Nations, 2023), will take place largely in Central/Middle Africa (CA) (114% between 2021 and 2050), Western Africa (WA) (85%) and Eastern Africa (EA) (84%) while human population growth will be limited in Northern Africa (NA) (46%) and Southern Africa (SA) (26%). Urbanization rate is expected to increase from 43.0% in 2021 to 59.9% in 2050. The number of Africans living in extreme poverty was estimated to have jumped from 284 million in 1990 to 433 million in 2018 (United Nations, 2023). In 2020, the poverty rate in sub-Saharan Africa (SSA) was estimated to have not fallen fast enough to keep up with population growth in the region (Schoch and Lakner, 2020). In 2021, hunger still affected 278 million people in Africa (FAO et al., 2022). Poultry and people have had a shared history for thousands of years and current trends suggest that this is not about to change by 2030. While growing market is essentially benefiting large-scale operations, access to market is also critical for small holders. Poultry birds can be sold in times of crisis and act as household insurance and economic stability. While poultry meat and eggs are the largest sources of animal protein in the human diet and poultry enterprises are high income-generating activities for value chains’ actors in Africa, demands for poultry have been increasing rapidly. However, the reported trends in demands are not matched with the local production of poultry products. Poultry value chains (PVCs) represent the alternatives to feed the fast-growing human population and generate income to low resource value chains’ actors. In Africa, poultry are kept and raised in a wide range of production systems, from small extensive scavenging to large-scale intensive systems, and provide mainly meat, eggs and manure for crop fertilisation. However, according to Branckaert and Guèye (2000) and Jim (2021), most of the conditions required by the intensive poultry subsector are not met in most African countries, namely (i) the ability to purchase most inputs, i.e. improved birds, feeds, vaccines, drugs and equipment; (ii) the availability of a highly skilled manpower; (iii) the presence of a strict disease control; and (iv) the existence of national domestic markets able to absorb poultry products at attractive prices by consumers with adequate purchasing power. In fact, prior to developing medium to large-scale poultry units, either for broiler or egg production, it is important to achieve either self-sufficiency in cereal products or to generate the required hard currencies provided by the export of expensive raw materials, or to have a developed services sector. Poultry mainly reared in large scale and intensive operations make them one of the fastest growing agricultural subsectors.Current state and trends in poultry numbers

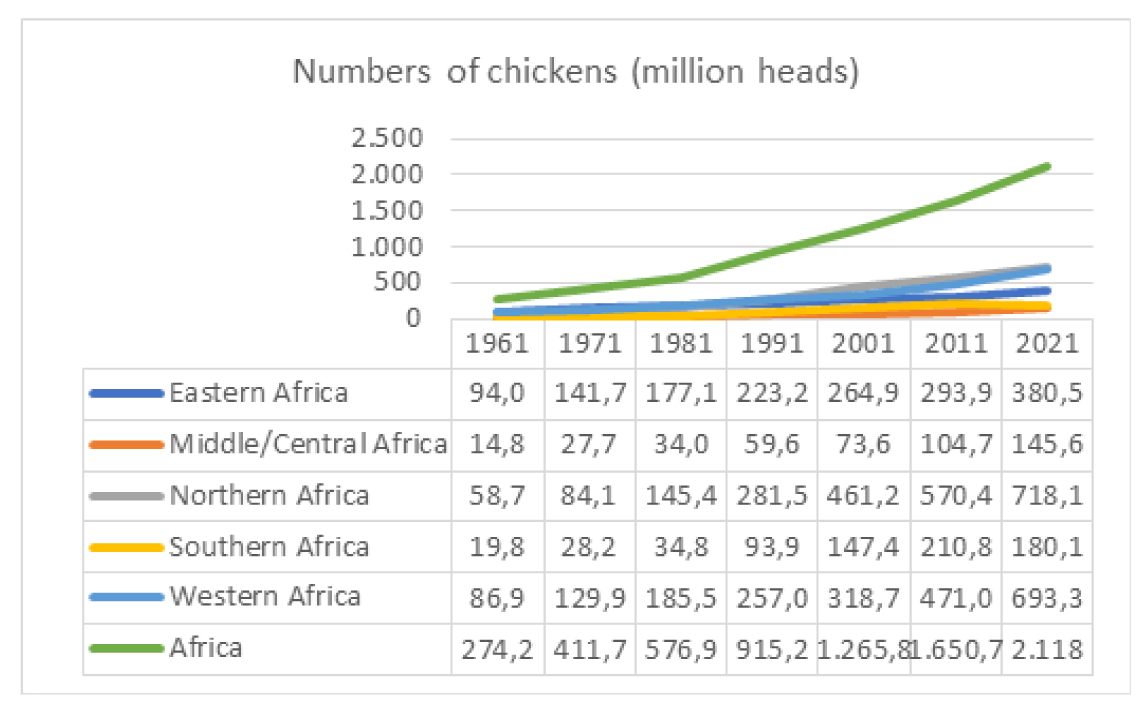

The Africa’s total poultry numbers were estimated in 2022 to be 2,425 million heads of poultry birds, consisting of 2,352 million chickens, 32 million turkeys, 22 million geese and 19 million ducks. Thus, chickens accounted for 97.0% of Africa’s total poultry numbers in 2022. About 34% of chickens were kept in Northern Africa (NA), 33% in Western Africa (WA), 18% in Eastern Africa (EA), 8% in Southern Africa (SA) and 7% in Central Africa (CA) (FAOSTAT, 2024) (Table 1 and Figure 1).Table 1.Countries of Africa’s sub-regions (FAOSTAT, 2024).

Figure 1.Numbers of chickens in Africa and by its sub-regions (Data from FAOSTAT, 2024).

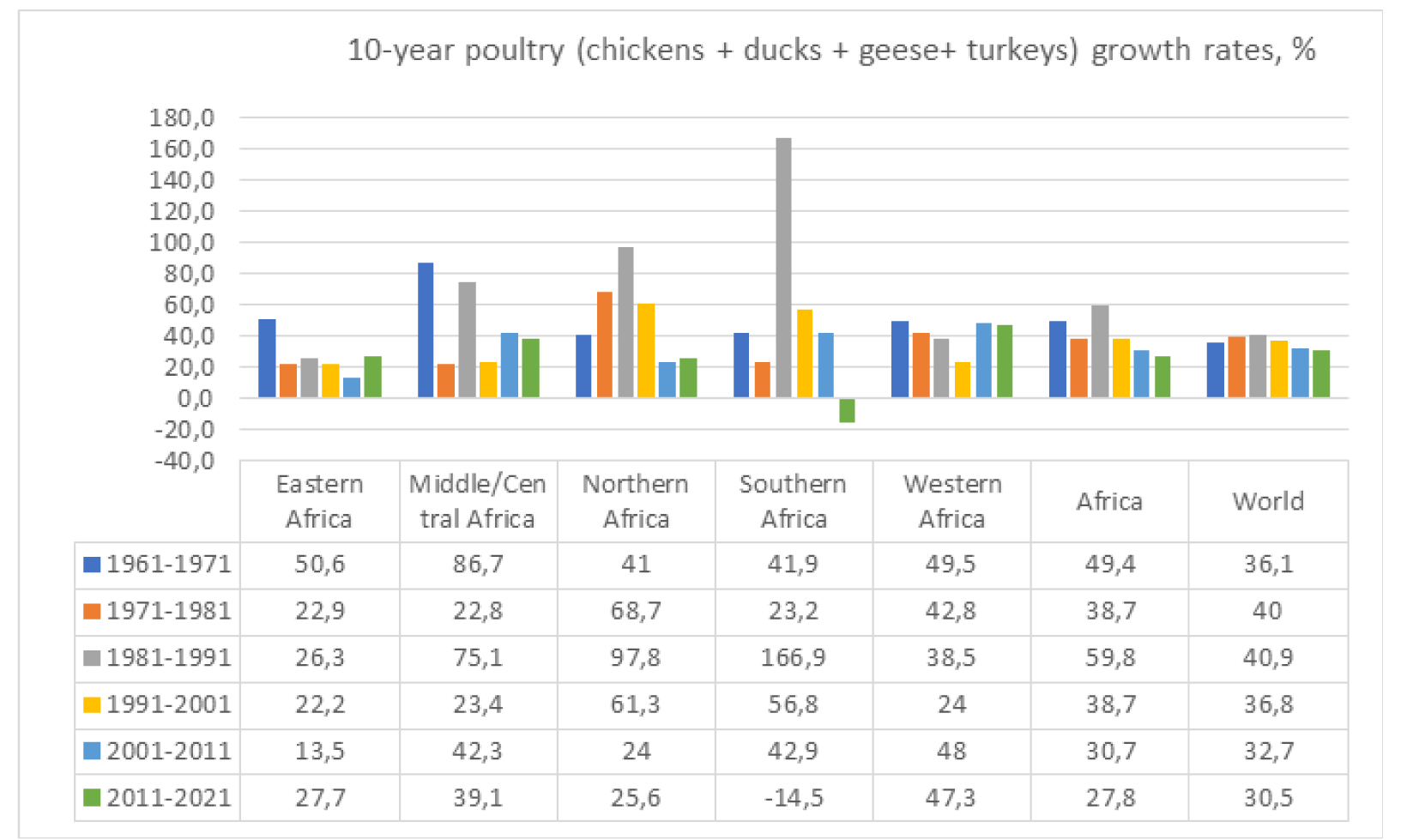

Figure 2.10-year poultry (chickens + ducks + geese + turkeys) growth rate in the world, Africa and by its sub-regions (Calculated from data from FAOSTAT, 2024).

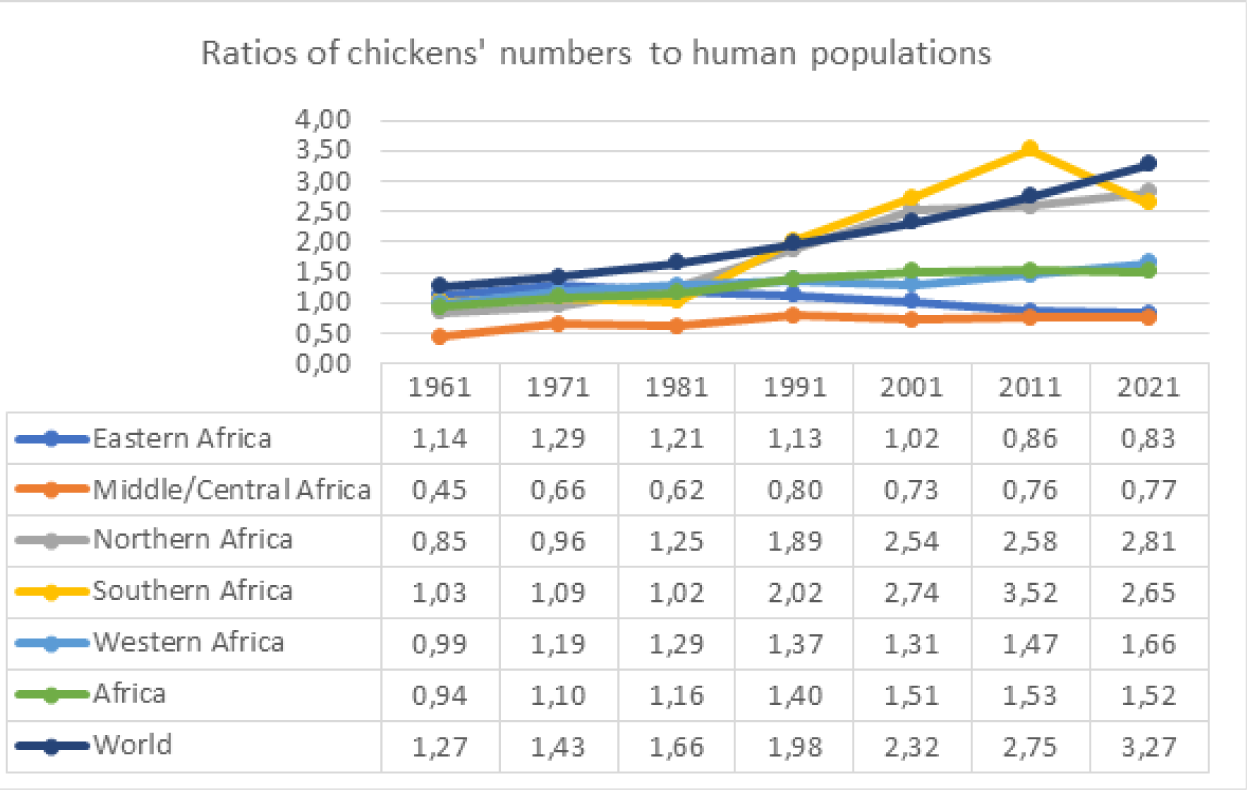

Figure 3.Ratios of chickens’ numbers to human populations in the world, Africa and by its sub-regions (Calculated from data from FAOSTAT, 2024).

Current state and trends in poultry production systems

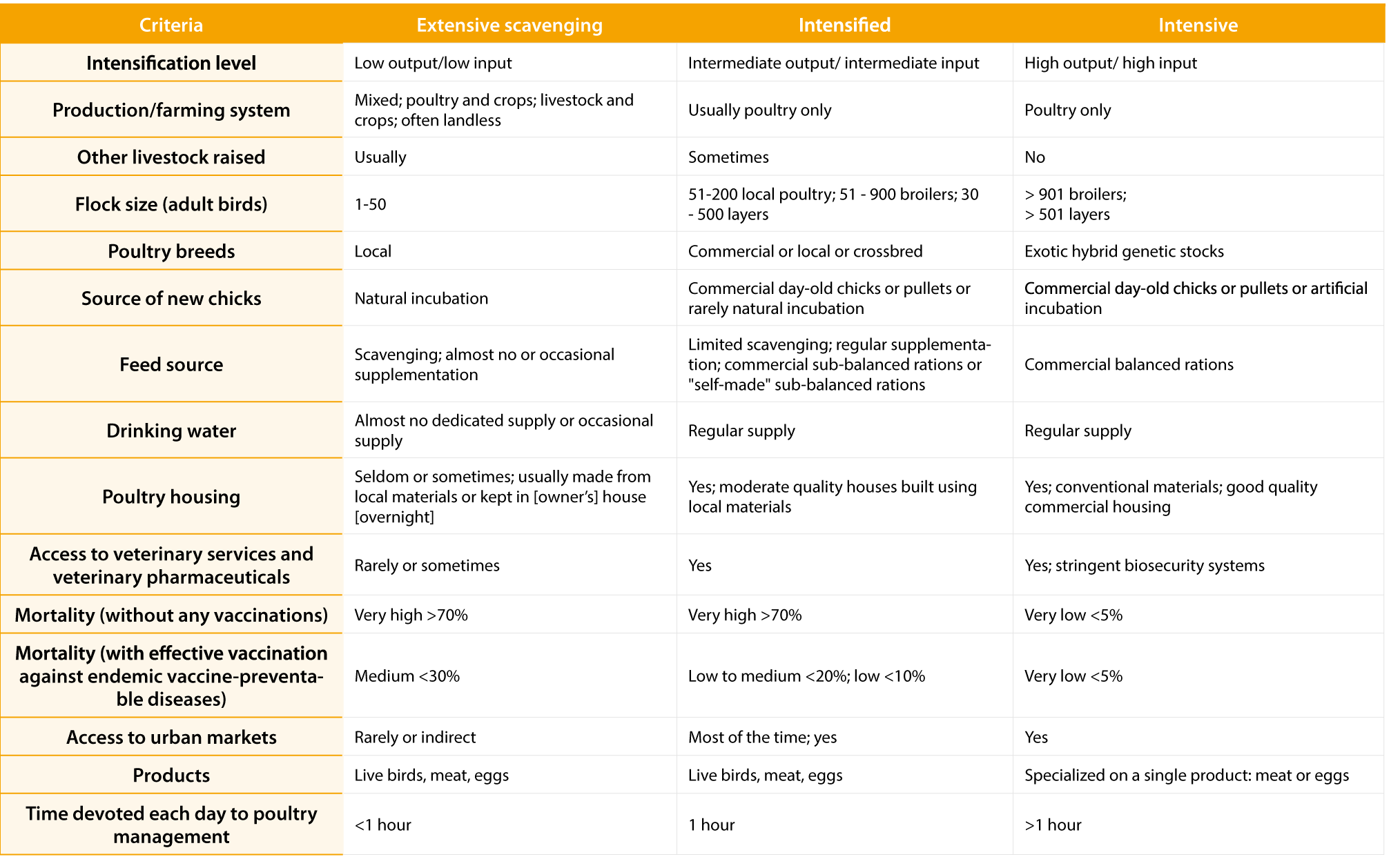

Poultry production is very divers in Africa, and there are many typologies available, responding to different aims and objectives. This diversity can be characterised considering factors that may include the main purpose of the flock, feed, orientation and the type of housing. Based on intensification level, three main types of poultry production systems can be considered: extensive scavenging system, intensified system and intensive system (Table 2). In Africa, it is estimated that 50%, 30% and 20% of the poultry stocks are kept in extensive scavenging, intensified and intensive systems, respectively (Guèye, 2024).Table 2.Characteristics of poultry production systems in Africa (Adapted from Branckaert and Guèye, 2000; Besbes et al. 2012; Thieme et al., 2014; Chaiban et al., 2020; Jim, 2021 and Guèye, 2022).

Poultry as a source of food

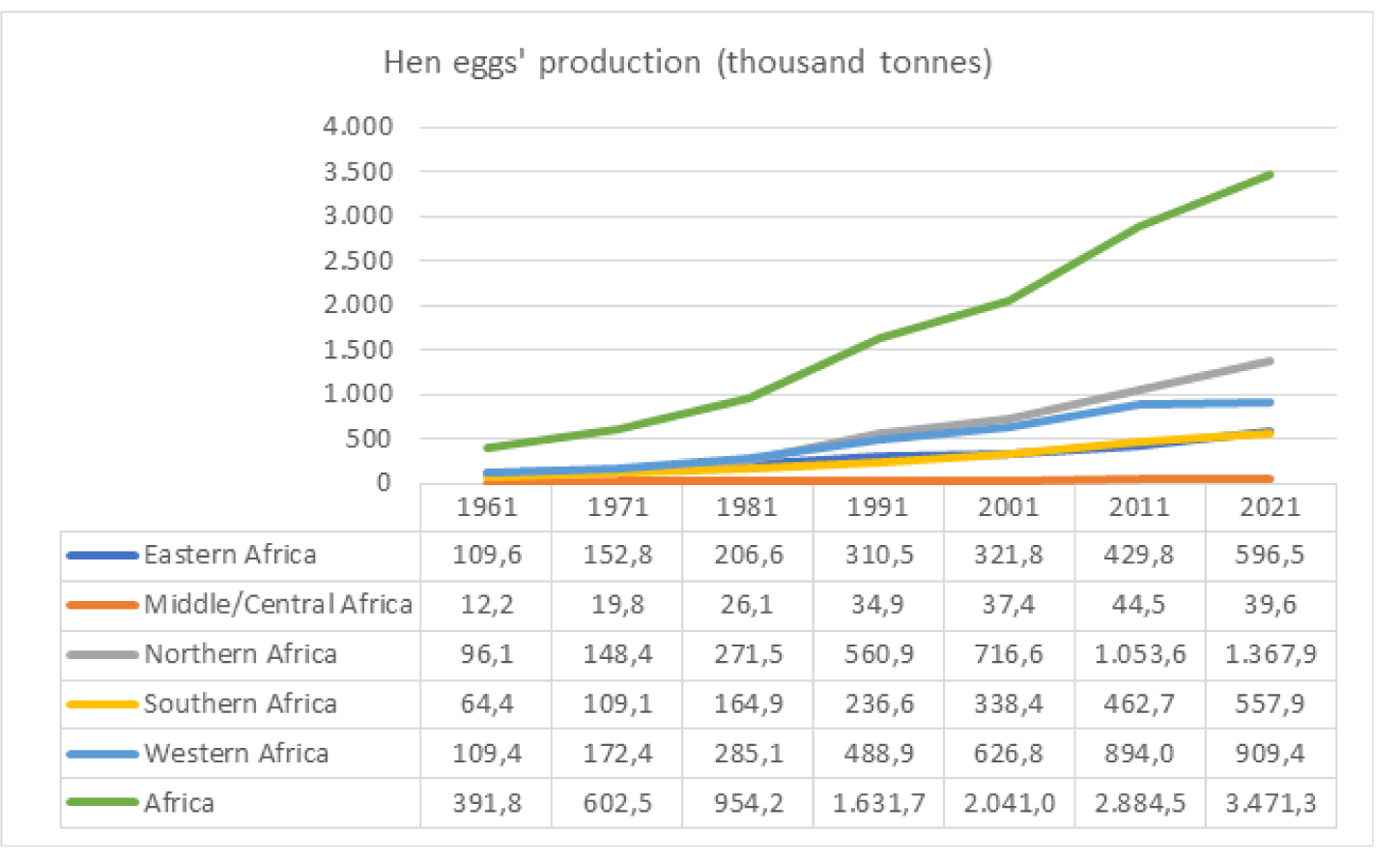

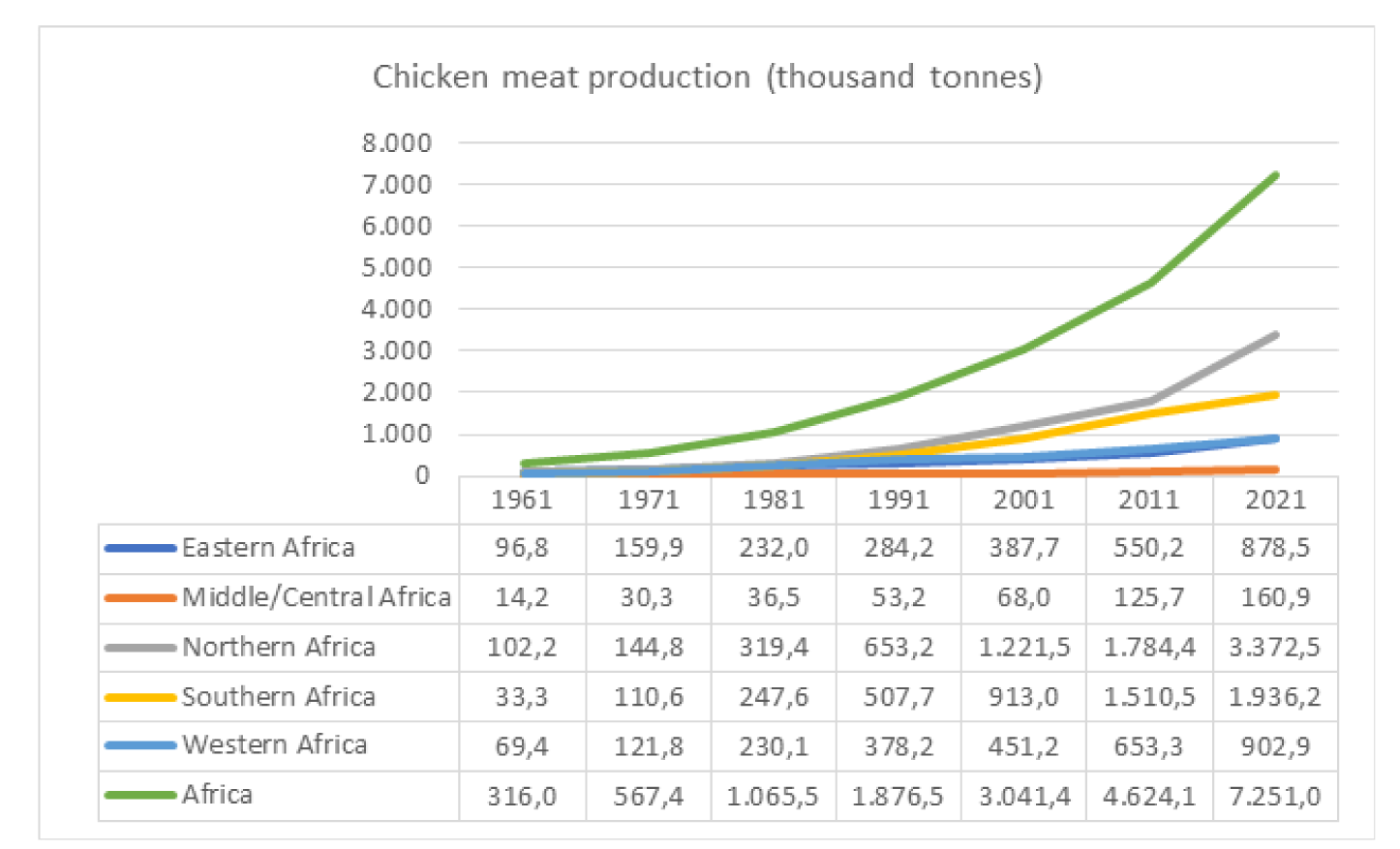

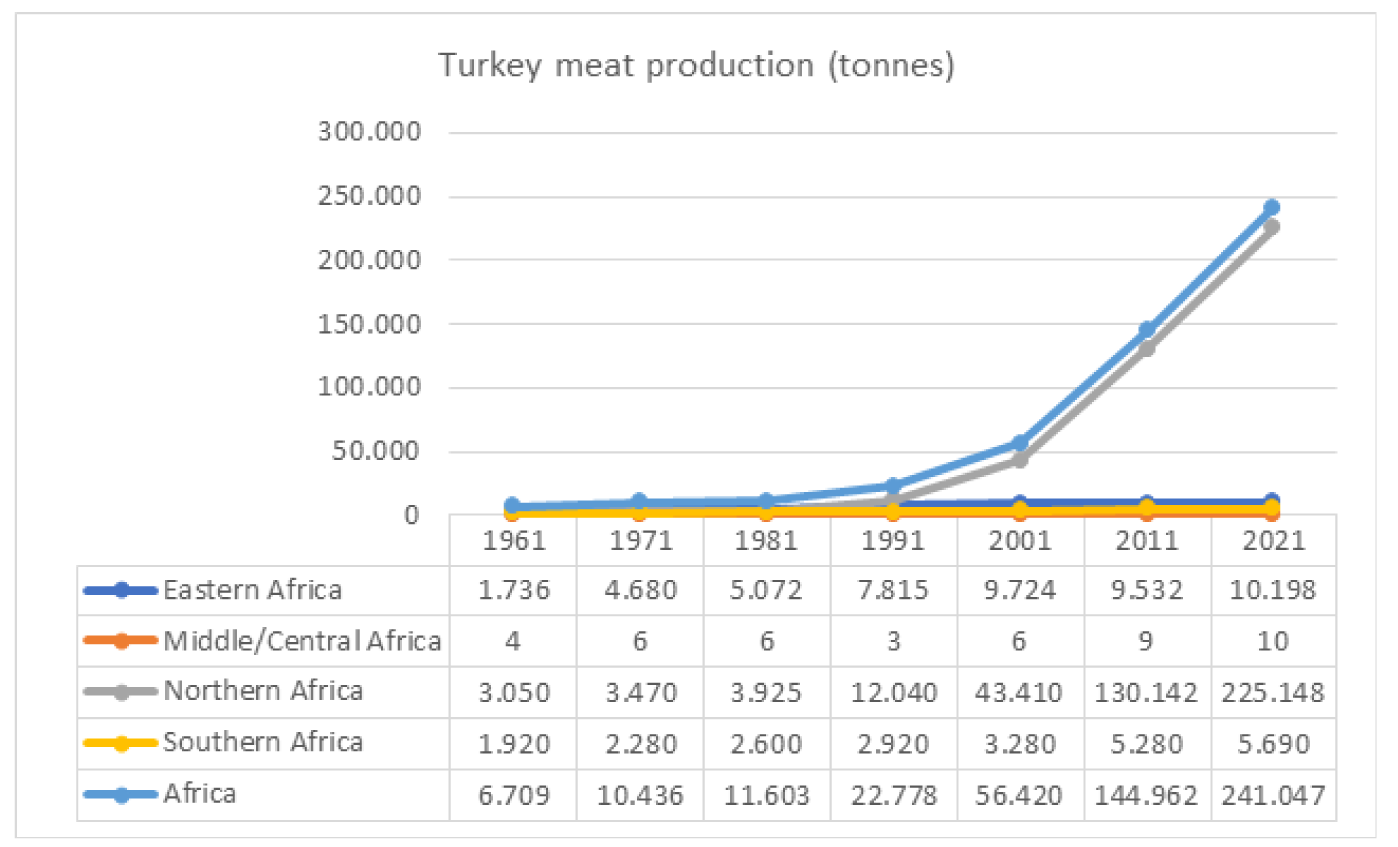

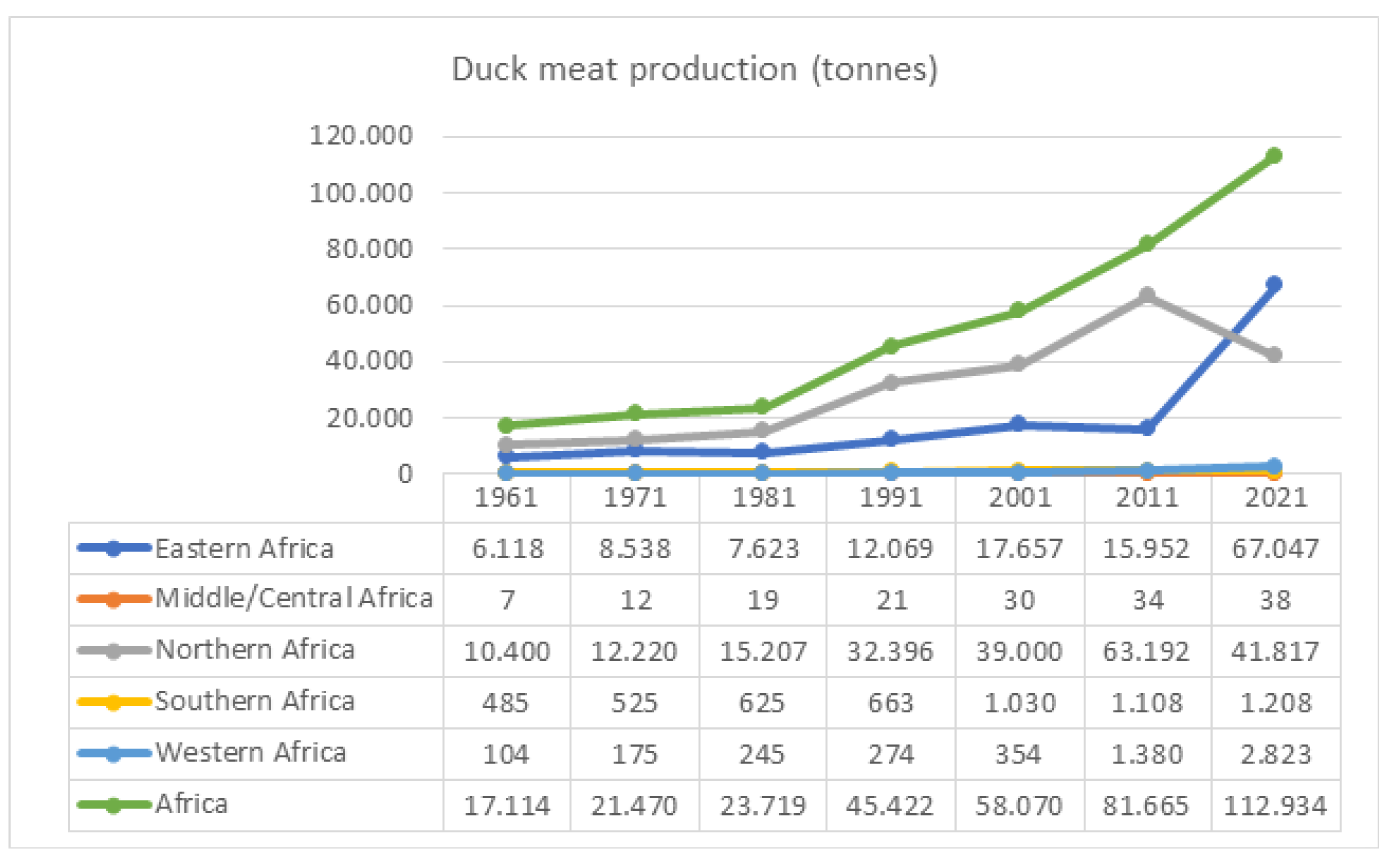

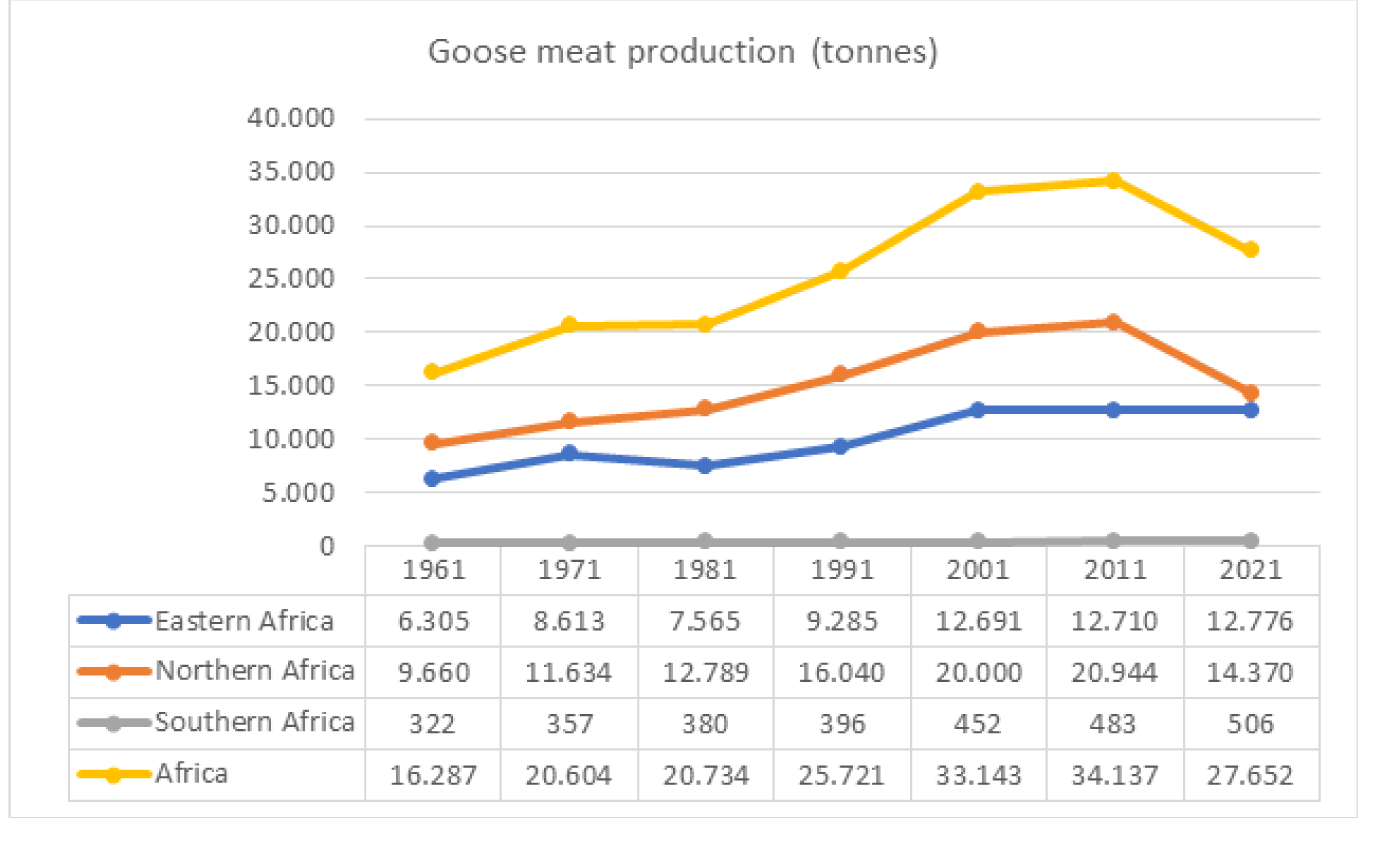

Throughout Africa, especially in the less-favoured areas such as noncoastal, remote, hilly and densely populated regions with no mineral resources and where the arable land is often scarce, poultry production is one of the most readily available and affordable sources of animal protein for PVCs’ actors. The total poultry production of Africa was estimated in 2022 to be 4,008 thousand metric tons (MT) of hen eggs; 7,810 thousand MT of chicken meat; 250 thousand MT of turkey meat; 86 thousand MT of duck meat; 26 thousand MT of goose meat and 17 thousand MT of meat of pigeons and other birds (FAOSTAT, 2024). About 40% and 26% of Africa’s hen eggs were produced in NA and WA, respectively (Figure 4). Chicken meat was produced mainly in NA (47%), followed by SA (27%) (Figure 5). Other poultry meats in Africa were mainly produced in NA (93% of turkey meat) (Figure 6); in EA and NA with 59% and 37% of duck meat, respectively (Figure 7); and in NA and EA with 52% and 46% of goose meat, respectively (Figure 8).Figure 4.Hen egg production in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 5.Chicken meat production in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 6.Turkey meat production in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 7.Duck meat production in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 8.Goose meat production in Africa and by its sub-regions (Data from FAOSTAT, 2024).

PVCs as sources of wealth creation

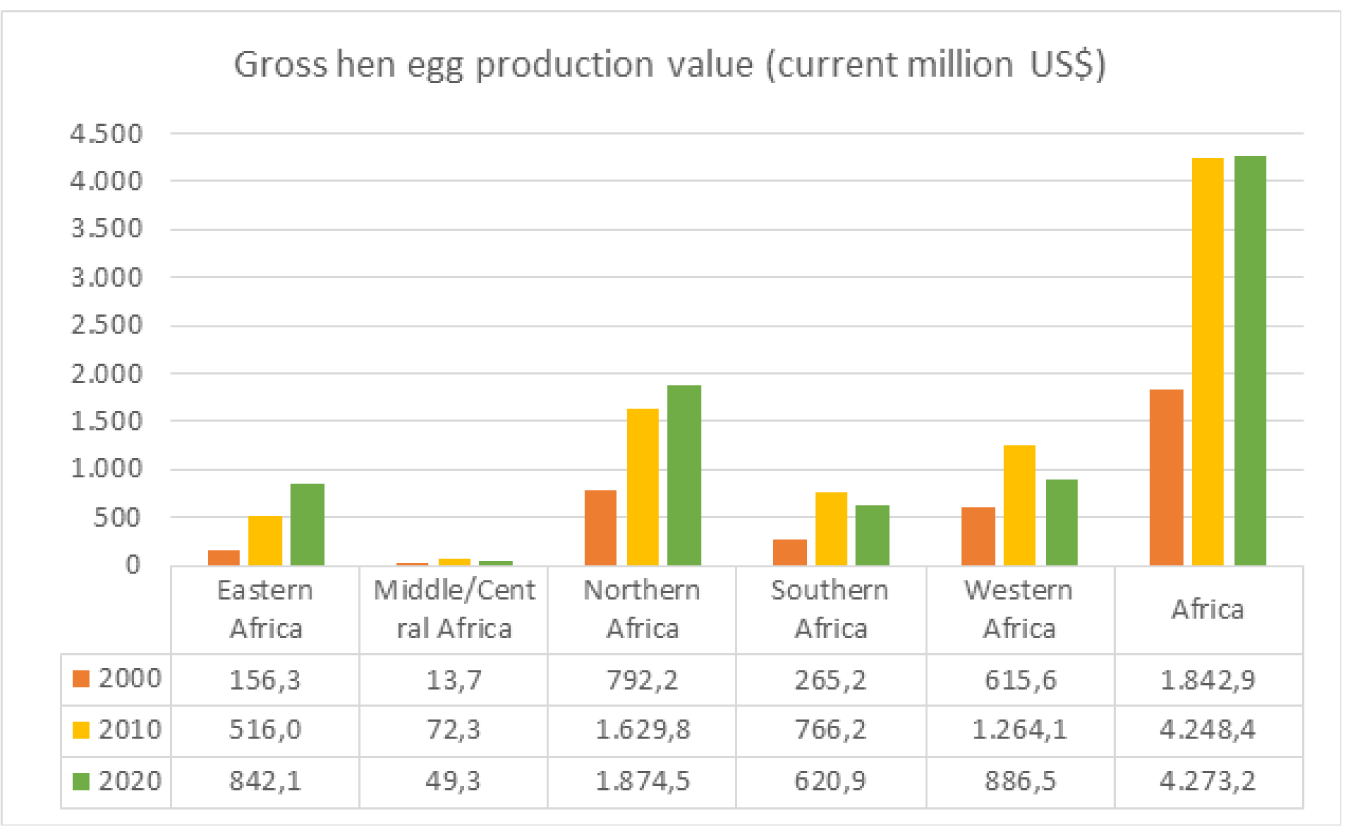

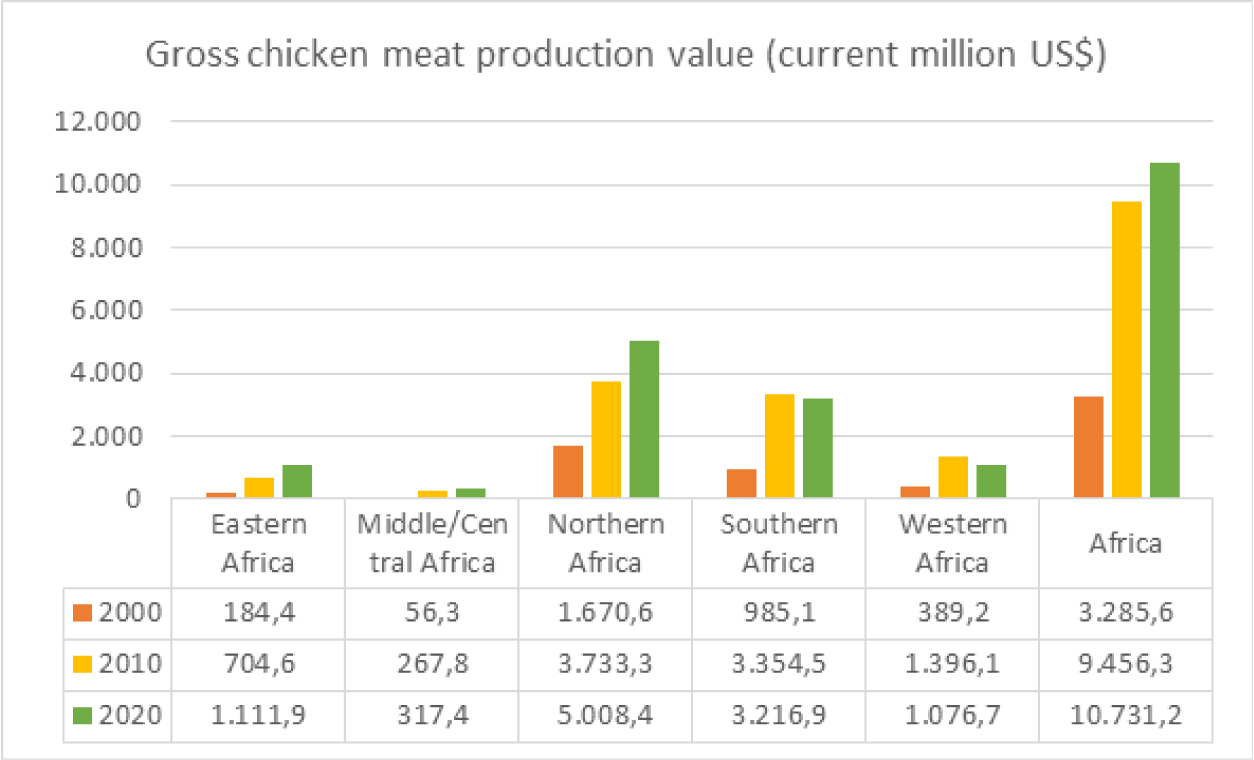

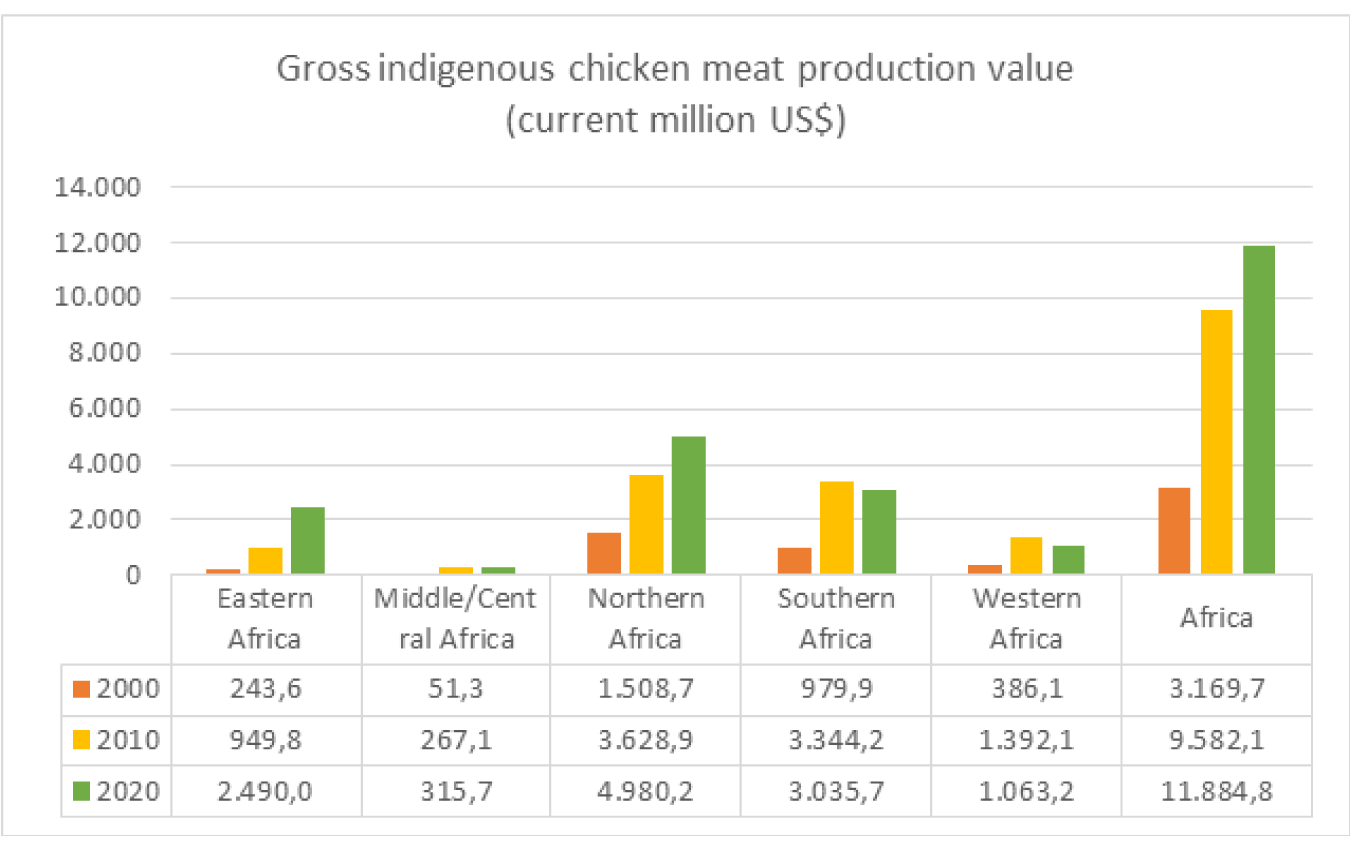

The Africa’s poultry production systems, which are sources of income and well-being for PVCs’ actors, are financially economic and highly profitable. The gross poultry production values in Africa were estimated in 2022 to be 4,947 million US$ for hen eggs; 13 million US$ for eggs from other poultry birds; 14,459million US$ for chicken meat; 14,366 million US$ for indigenous chicken meat; 565 million US$ for turkey meat; 532 million US$ for indigenous turkey meat; 289 million US$ for duck meat; 285 million US$ for indigenous duck meat; 101 million US$ for goose meat; and 51 million US$ for meat of pigeons and other poultry birds (FAOSTAT, 2024). About 44%, 21% and 20 % of Africa’s gross hen egg values were produced in NA, WA and EA, respectively (Figure 9). Gross chicken meat values were produced mainly in NA (47%), followed by SA (30%) (Figure 10). Gross indigenous chicken meat values were mainly produced in NA (42%), SA (26%) and EA (21%) (Figure 11).Figure 9.Gross hen egg production value in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 10.Gross chicken meat production value in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 11.Gross indigenous chicken meat production value in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Current state and trends in poultry trade

Imports of poultry products

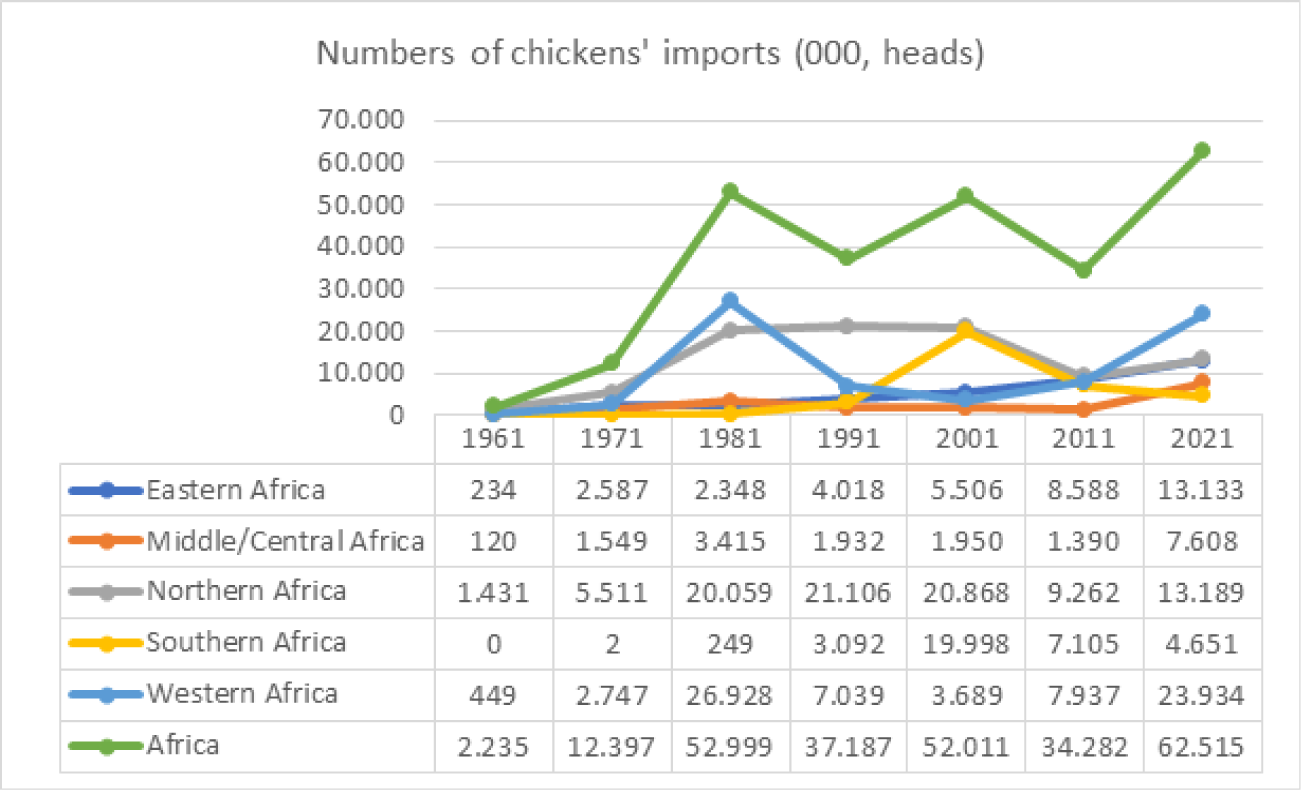

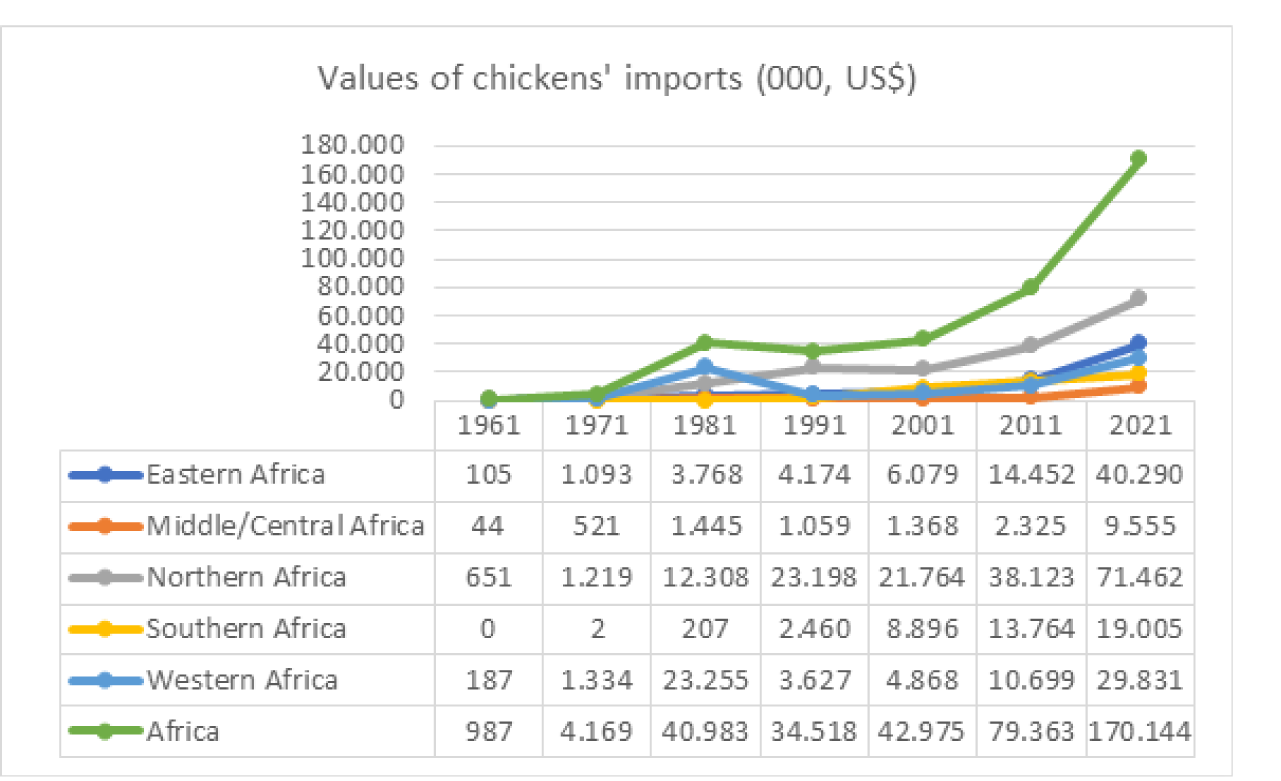

The Africa’s total chickens’ imports from United States, European Union (EU), Brazil, Argentina, Mexico and Chile were estimated in 2022 at 51 million heads, with a value of 189 million US$ (FAOSTAT, 2024). The chickens’ imports tend to be increasing since 1961, but at irregular rates, except for EA and SA where the increases in values of chickens’ imports have been steady. In 2021, main importers of chickens’ numbers were WA (38%), NA (21%) and EA (21%) (Figure 12), while main importers of chickens’ values were NA (42%), EA (24%) and WA (18%) (Figure 13).Figure 12.Numbers of chickens’ imports in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 13.Values of chickens’ imports in Africa and by its sub-regions (Data from FAOSTAT, 2024).

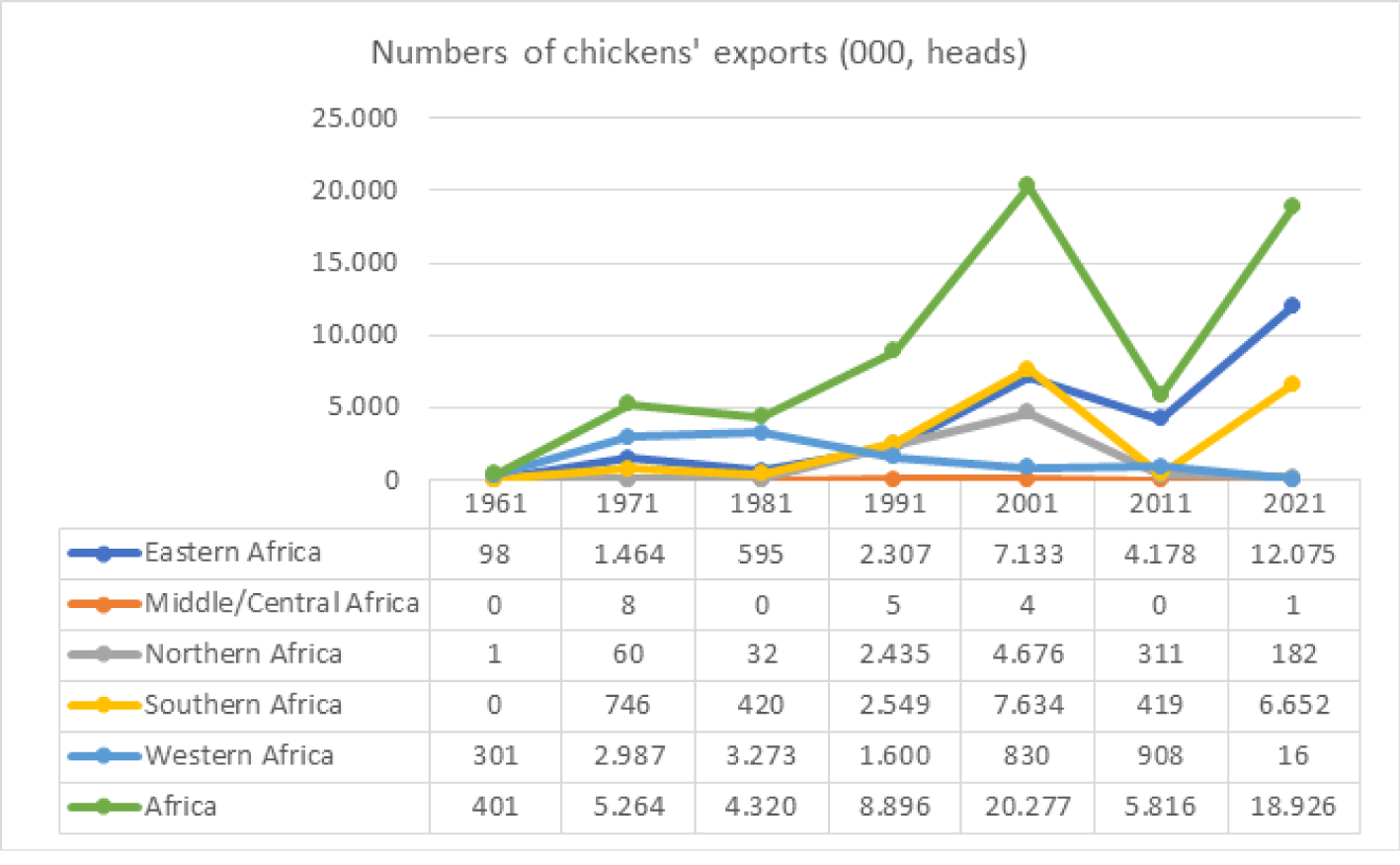

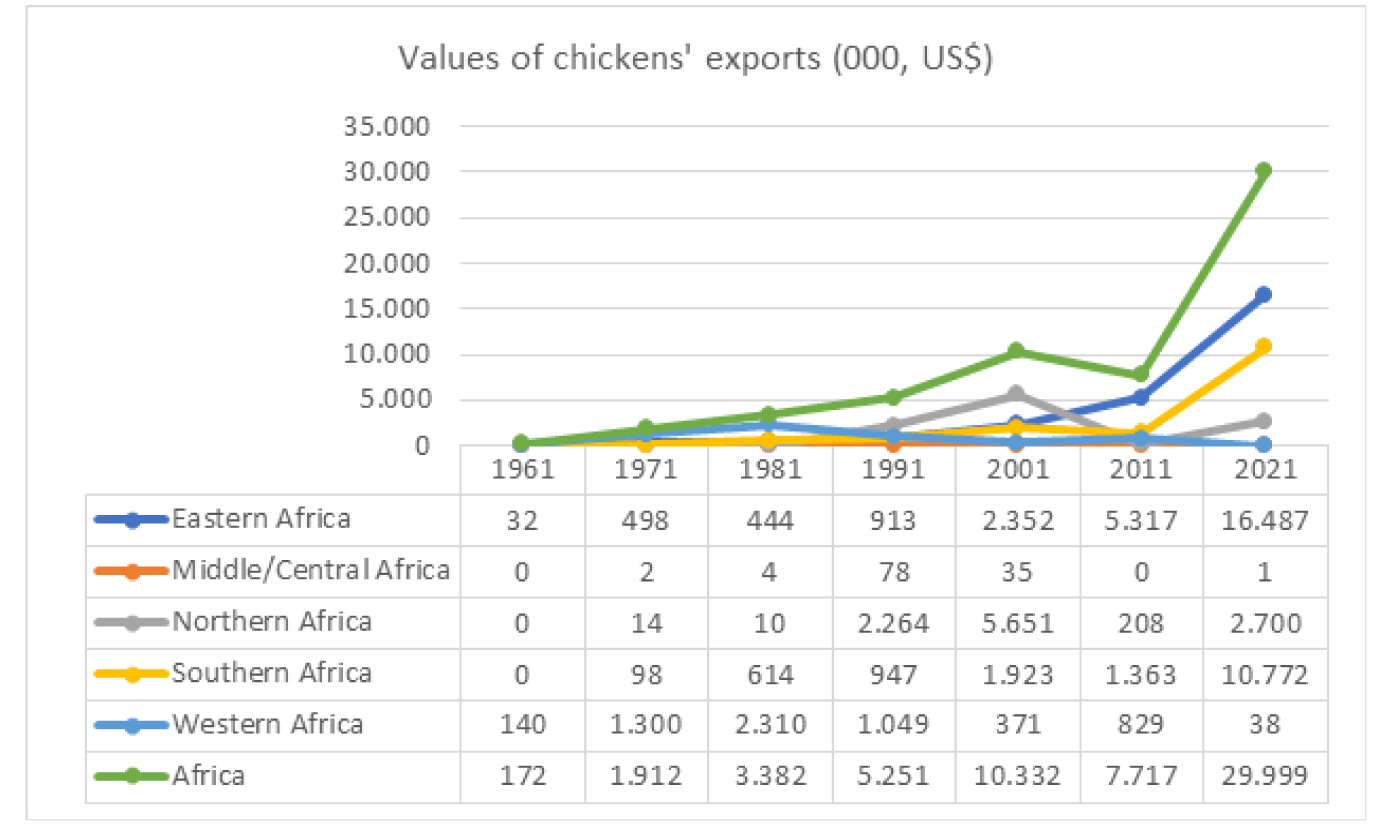

Exports of poultry products

The total chickens’ exports from Africa were estimated in 2022 at 19 million heads, with a value of 45 million US$ (FAOSTAT, 2024). The chickens’ exports tend to be increasing since 1961, but at irregular rates, except for EA where the increases in values of chickens’ exports have been steady. The main exporters of chickens’ numbers in 2021 were EA (64%) and SA (35%) (Figure 14), while main exporters of chickens’ values were EA (55%) and SA (36%) (Figure 15).Figure 14.Numbers of chickens’ exports in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Figure 15.Values of chickens’ exports in Africa and by its sub-regions (Data from FAOSTAT, 2024).

Current state and trends in consumption of poultry products

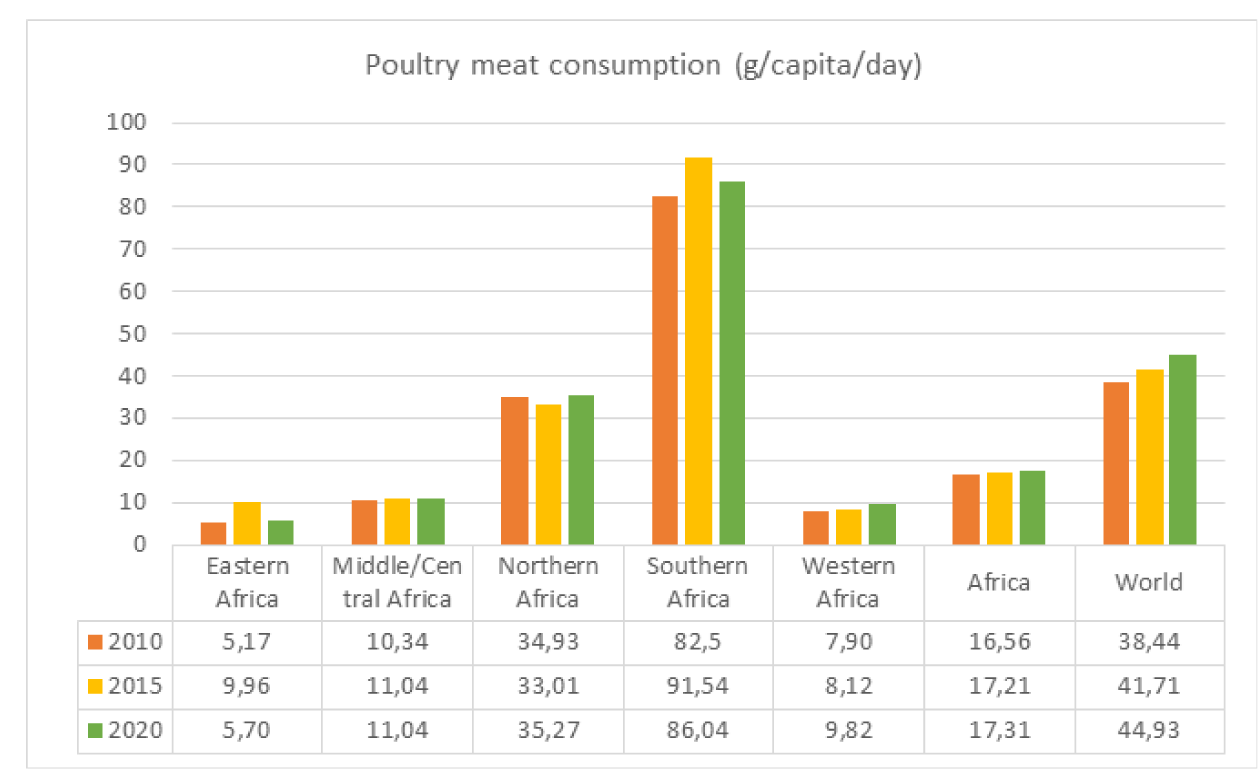

Poultry meat consumption

The per capita poultry meat consumption was estimated in 2020 to be 17.31 g per day in Africa, compared with 44.93 g per day in the world (FAOSTAT, 2024) (Figure 16). This was significantly correlated with the per capita GDP in 2020 (r = 0.99, p <0.001). Chicken meat consumption in Africa constituted 83.0% of poultry meat consumption in 2022. From 2005/07 to 2050, consumption for poultry products in Africa is projected to grow from 1.6 to 6.1 million MT for eggs and from 2.9 to 11.8 for poultry meat (Erdaw, 2023). The consumption of poultry meat in Africa is projected to grow from 9.1 to 12.6 million MT between 2020/22 and 2032, whereas the average annual growth in poultry meat consumption is projected to decrease from 3.41 % over 2013-22 to 2.88 % over 2023-32 (OECD and FAO, 2023).Figure 16.Poultry meat consumption in the world, Africa and by its sub-regions (Data from FAOSTAT, 2024)

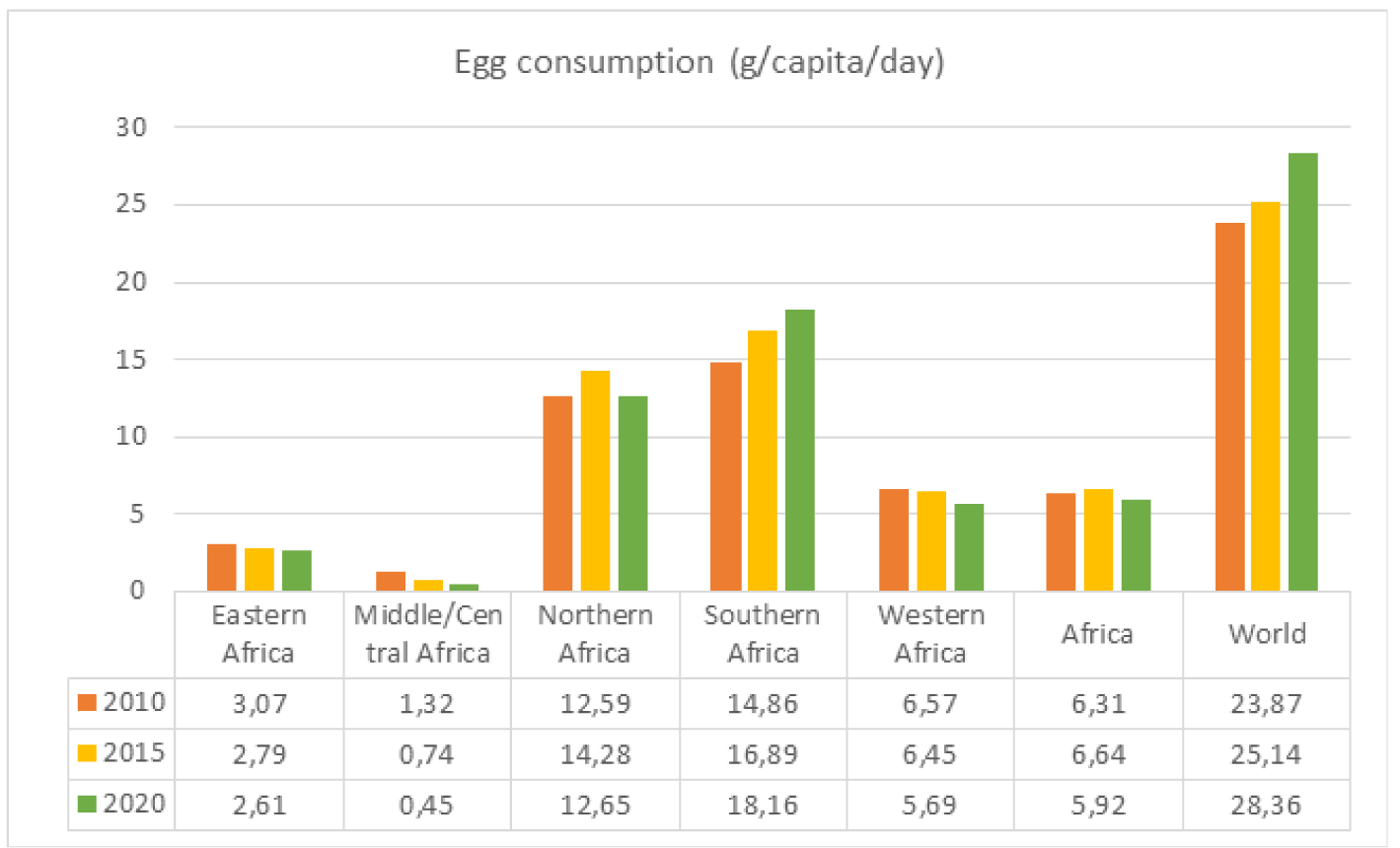

Egg consumption

The egg consumption in Africa is projected to remain unchanged at 2.1 kg per capita from 2020/22 to 2032, while the average annual growth of consumption is projected to increase from -1.26 % over 2013-22 to -0.08 % over 2023-32 (OECD and FAO, 2023). The per capita egg consumption was estimated in 2020 to be 5.92 g per day in Africa, compared with 28.36 g per day in the world (FAOSTAT, 2024) (Figure 17). This was significantly correlated with the per capita GDP in 2020 (r = 0.94, p <0.01). Hen egg consumption in Africa constituted 99.8% of poultry meat consumption in 2022.Figure 17.Egg consumption in the world, Africa and by its sub-regions (Data from FAOSTAT, 2024).

Trends of poultry products consumption

The overall trend of per capita poultry products consumption in Africa is increasing. Africans eat, on average, only 8.5 eggs per year compared to the global average of 161 eggs per person per year (Erdaw and Beyene, 2022). Besides, an African consumes on average only 3.3 kg of poultry meat per year compared to 14 kg worldwide (World Bank, 2017). Smith and Nouala (2015) predicted that the consumption of chicken and pig meat would exceed red meat consumption by 2030 in most of the SSA countries. By 2030, a 6-7 fold continent-wide increase in consumption of pork and poultry meat is expected, with especially high growth in WA. The growing middle class in Africa, along with rapid urbanisation, progressive growth of human population and income improvements, is changing its consumption patterns, moving from vegetable-based consumption to a more protein-rich diet. Mulder (2017) reported that poultry and eggs are the protein of choice for African consumers, making poultry production easier to start up and expand while attracting more investors. Thus, there are trends in building smarter PVCs establishments, such as breeding stocks, out-grower farms and processing facilities in some of the SSA countries.

Challenges of poultry value chains

Status of poultry value chains

Africa, imports 83% of the food that is consumed, and this is due to overall weakness of the agricultural system (Juma, 2016). The main challenges of poultry value chains (PVCs) in Africa are lack of sufficient maize and other cereal grains, soybean, problems of feed-food competition, dependency on importation of improved breeds and day-old chicks, disease prevalence and low purchasing power of the consumers. Low employment levels, sluggish improvement of the selling of poultry products and generally the low levels of income of the society negatively influence the consumers’ market in Africa. Exaggerated prices of poultry feeds in Africa are not as equally an issue to other parts of the world. The skyrocketing price and adulteration of poultry feeds are some of the upcoming concerns to some of the SSA countries (Adeyemo and Onikoyi, 2012; Heise et al., 2015; FAO, 2018; Nkukwana, 2018; Tabler et al., 2021; Erdaw and Beyene, 2022). Furthermore, the poultry industry in NA is being more severely impacted by the food crisis due to the disruption of Ukrainian grain exports and other challenges (Vorotnikov, 2023). Also, in Côte d’Ivoire, Yao (2023) reported that, while the broiler production enjoyed an average annual growth of 13.8% since 2009, the production has declined over the last three years due to the prevalence of Highly. Pathogenic Avian Influenza (HPAI) outbreaks in the areas surrounding Grand Bassam. Besides, while the hatcheries produced 61 million day-old chicks in 2020, the figure is expected to reach a production of 70 million day-old chicks annually by the end of 2023. Moreover, COVID-19 has also dramatically negatively impacted poultry production due to increased freight costs for production inputs in Kenya (Mbijiwe et al., 2021) and Côte d’Ivoire (Yao, 2023). The market accessibility for consumers of poultry products in Africa is generally limited mostly because of poverty, levels of employment and sluggish development of the fastfood chicken outlets (Oosthuysen, 2013; Kusi et al., 2015; Erdaw and Beyene, 2022). Lack of processing facilities and markets for poultry products are the other discouraging scenarios of the Africa’s poultry producers. For example, Moreki (2010) reported that lack of butchery services for small-scale broiler producers, low quality and unorganised supply of feeds and stocks, delayed allocation of land and inadequate extension service were the main challenges for the poultry industry in Botswana. Besides, most of the commercial poultry farms in Ghana, which were established in late 1960s and early 1970s, have been steeply declining since the year 2000 due to importation of poultry products (Kusi et al., 2015). To compensate for negative effects of Europe’s cheap chicken exports to Africa on local PVCs, targeted support measures would make more sense economically and socially than general import restrictions (Knößlsdorfer and Qaim, 2023). Furthermore, Adeyemo and Onikoyi (2012) reported that high feed costs, poor quality of both feed ingredients and chicks, inadequate access to and high cost of veterinary services and poor marketing information systems are some of the main challenges of the Nigeria’s PVCs, which, to a large extent, have slowed down further their growth.Future of poultry value chains

Demand for poultry in SSA will be primarily driven by the higher affordability of poultry compared to beef (OECD and FAO, 2023). Smith and Nouala (2015) reported that imports of the white meat into SSA are expected to double (16%) by 2050. Besides, SSA has no inclusive standards and quality controlling mechanisms for such imported items. There continues to be greater growth in demands for poultry products, but the small-scale producers face a strong competition, with that of the large-scale producers, specialised only in livestock (OECD and FAO, 2023). Poultry production certainly has been facing problems, including competition for grains, which needs to be resolved for the stakeholders (Farrelly, 1996; Mengesha, 2013; Tabler et al., 2021). If Africa cannot be able to increase its own grain production, it is hardly expected to increase its chicken production outputs (Mengesha, 2012a; Kusi et al., 2015; Juma, 2016).

Opportunities and prospects for poultry value chains

Opportunities of poultry value chains

Even though poultry meat is still the fastest growing subsector, production would be increasing at a slower rate than in past decades. In SSA, poultry consumption has expanded faster than any other meats (Mottet and Tempio, 2017). Poultry products’ prices show a strong link to feed costs, as their production uses more grain- and protein meal-based feed. The tendency is for the ratio of poultry meat to feed prices to remain within a relatively narrow band (OECD and FAO, 2022). While extensive poultry production systems are still common in SSA, a greater degree of intensification has been evident, particularly in countries such as South Africa that produce surplus feed grains. Albeit from a small base, feed intensity is expected to continue increasing in SA as supply chains modernise in countries such as Zambia and Tanzania, but many smaller producers continue to use non-grain, often informally procured feed inputs (OECD and FAO, 2022). Overall in SA, the net effect results in feed use growing at a marginally faster rate than poultry meat production. However, the pattern of meat consumption has changed significantly in Africa over the last 20 years, and this trend will continue for a foreseeable future. Beef and mutton used to be the most popular meats, but these have been replaced recently by chicken meat. The daily per capita poultry meat consumption in Africa was estimated in 2020 at 17.31 g, compared with 13.02 g for beef meat, 3.81 g for mutton meat, 2.73 g for goat meat and 0.67 g for camel meat (author’s calculations from FAOSTAT (2024)). This change in meat consumption pattern has been driven in part by the taste and also due to poverty as consumers have looked to the cheaper sources of protein.Prospects for poultry value chains

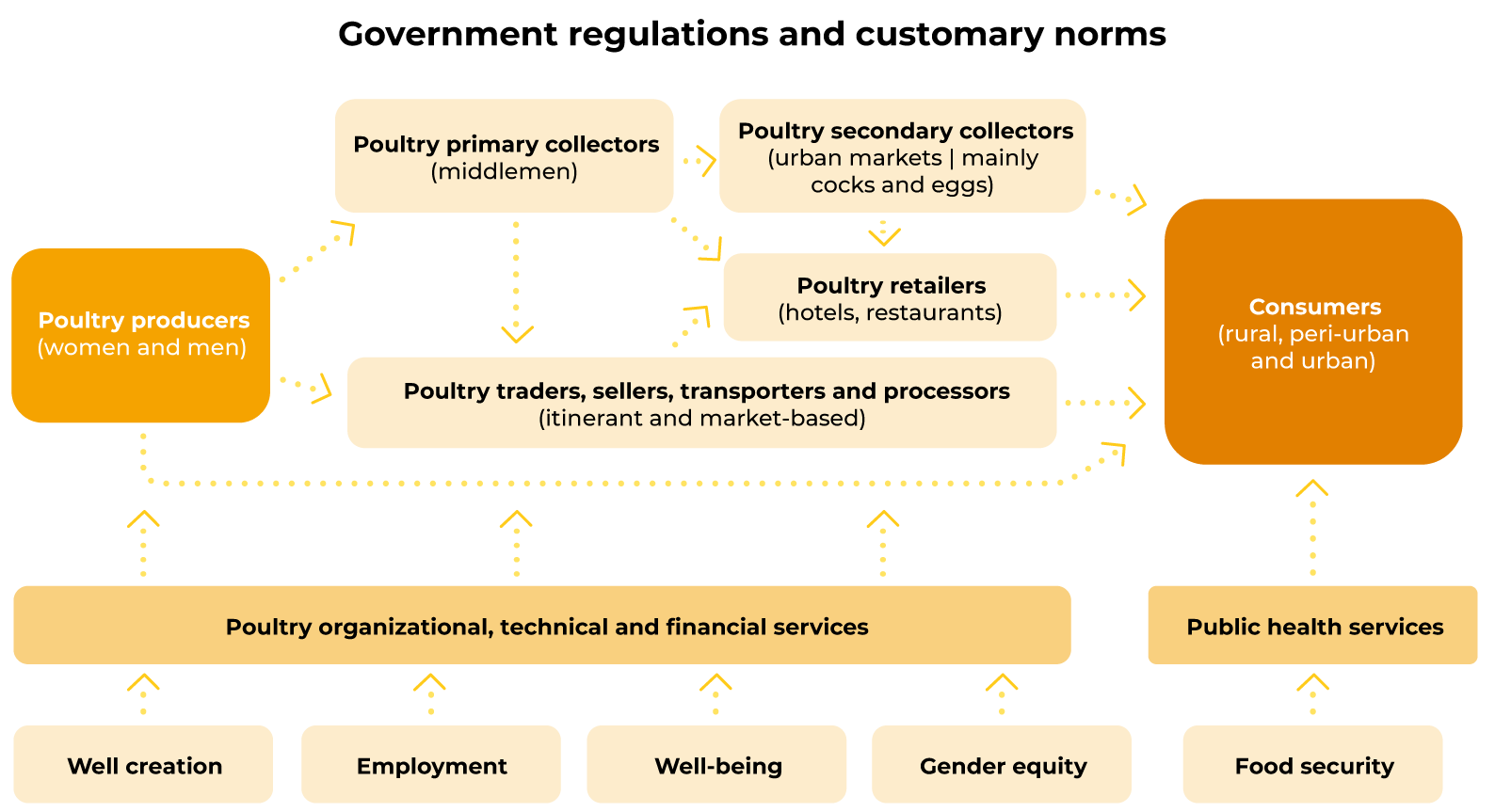

If science, innovation and technologies are to contribute to the improvement of PVCs, the human capital development and technology transfer of its wide range of actors playing respective roles should be considered (Nkukwana, 2018; Tabler et al., 2021; Guèye, 2022) (Figure 18). Development strategies for sustainable PVCs should be based on poultry science, education and training, research, extension, farmers’ organization, financial and advisory services. Focus should also be on strengthening collaboration between the private and public sectors, and enhancing innovative ways to articulate concerns from producers and consumers to policy makers that help remove barriers to technological adoption.Figure 18.Typical simplified poultry value chains.