The poultry industry in Russia is one of the fastest growing markets as compared

to other international markets not to mention one of the best performing sectors

in Russia. Despite great efforts, the industry has still not managed to reach the

high level of 1990, which is a goal for

many industries. It was the year of the

collapse of the Soviet Union and the beginning of a new era.

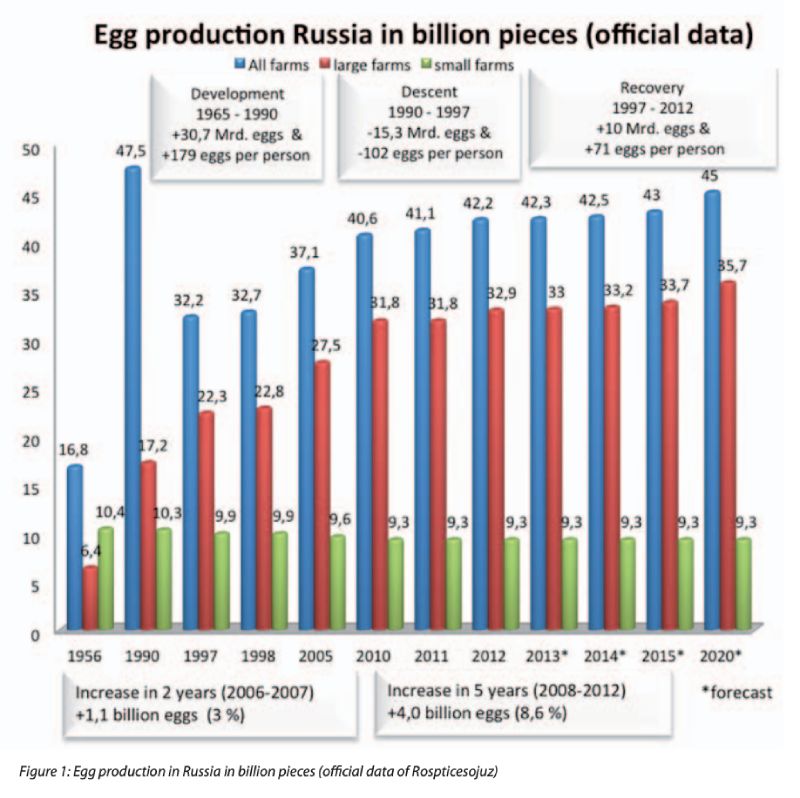

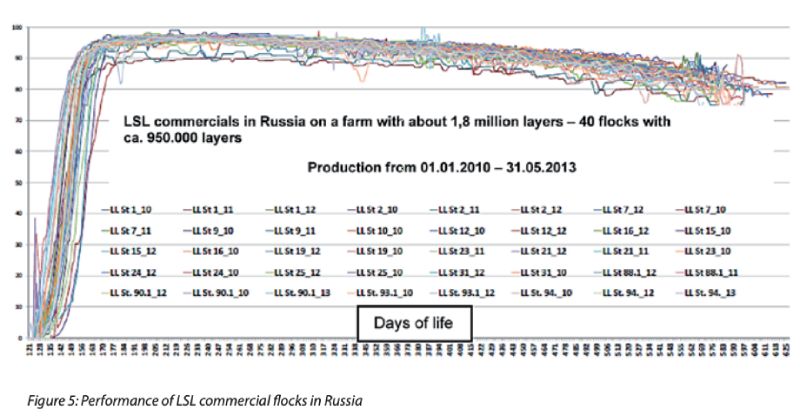

Development plans are often out of reach and despite tremendous growth in some regions, the past few years have shown stagnation in egg production. According to official figures, egg production is currently at about 42 billion eggs, of which just over 20 % (9.3 billion eggs) are produced in small house plants (Fig. 1, next page).

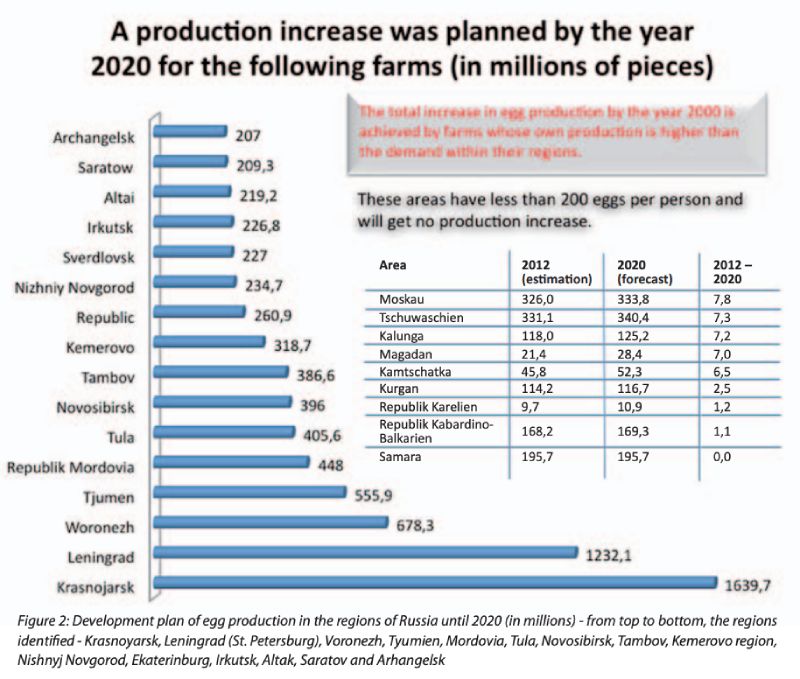

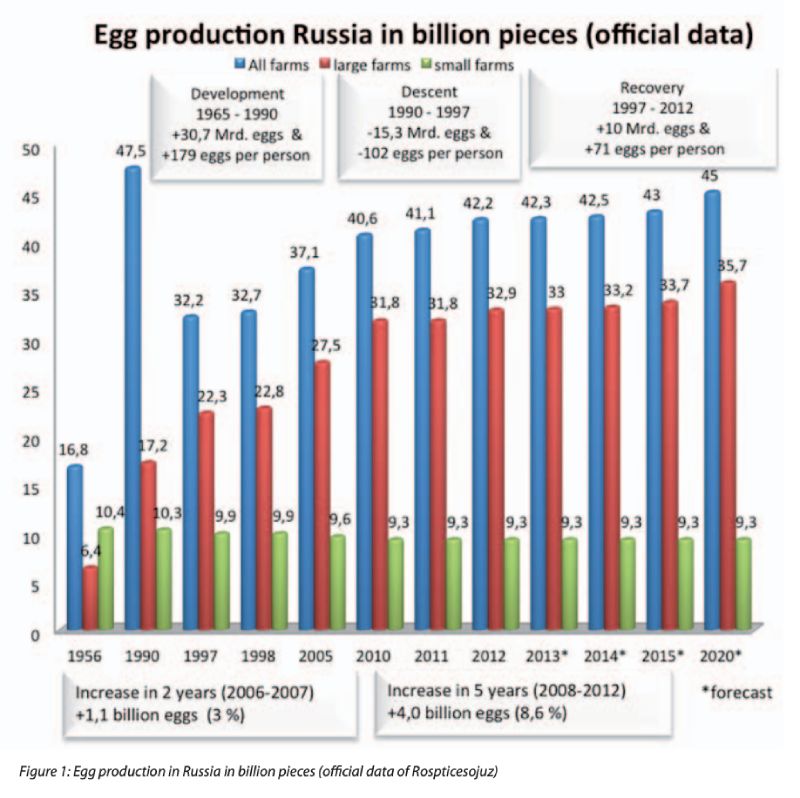

What seems to be quite unrealistic when compared to the rest of Europe, the per capita consumption of eggs lies at 297 eggs per year – a high level indeed. By 2020, this is expected to increase even more, i.e. up to 315 eggs per capita. However, if one looks at the actual development more closely, you will quickly discover that the increase in production takes place in only a few regions (Fig. 2).

In addition, it is striking that the largest increase is expected in regions that have limited feed resources, for example in Krasnojarskij Kraj Tumenskiy, Kemerowskiy and in the Nowosibirskiy region, which are in Siberia or in the Leningradskiy region (St. Petersburg) in the North. Southern regions of Russia and the Volga region, which have enormous reserves of feed, are rarely mentioned in the plans.

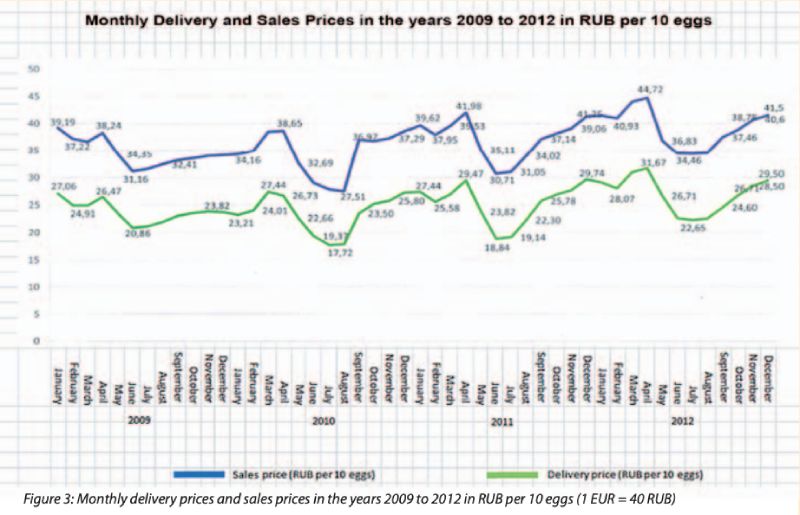

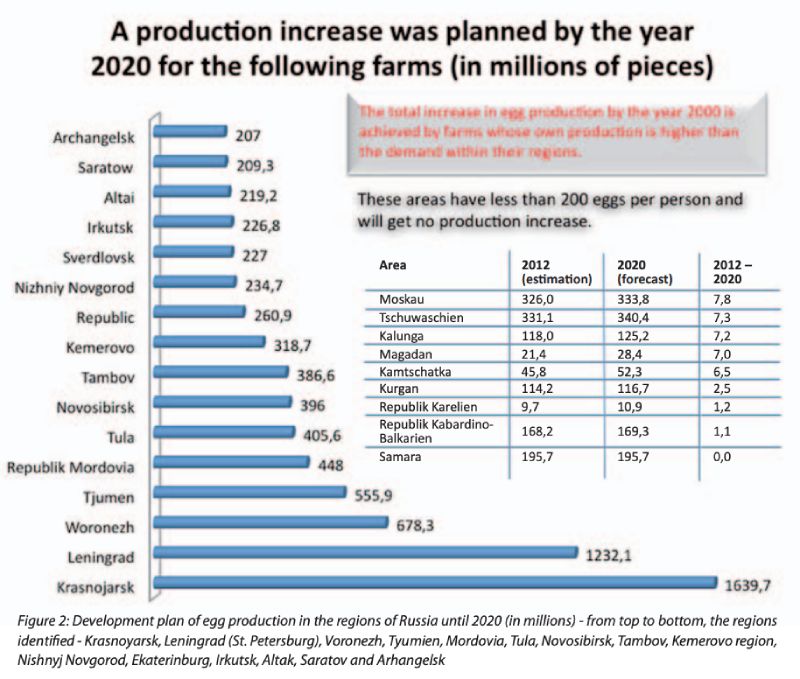

Like almost all countries of the world, Russia has huge problems with obtaining affordable raw feed materials. In recent years, grain was immediately exported after been harvested and poultry farms had to buy their feed at very high prices from distant regions. Raw materials that could be bought at relatively affordable prices, often did not meet the required quality. Grain from subsidized reserves of the country especially led to big problems due to their toxic load. Flocks which were affected due to the consumption of this feed displayed a deterioration in performance and also resulted in mortality. Despite rapid increases in feed prices from about RUB 4,000 per ton in 2008 –2009 and up to 12,000 –14,000 RUB/ton in May 2013 despite a relatively constant currency exchange rate of approximately RUB 40/EUR, egg prices remained constant, with the exception of seasonal fluctuations in the summer months. For years now, the delivery prices of the farms (Figure 3, green line) has been under RUB 30 per 10 eggs and the retailer sale price is at about RUB 40 per 10 eggs (Figure 3, blue line).

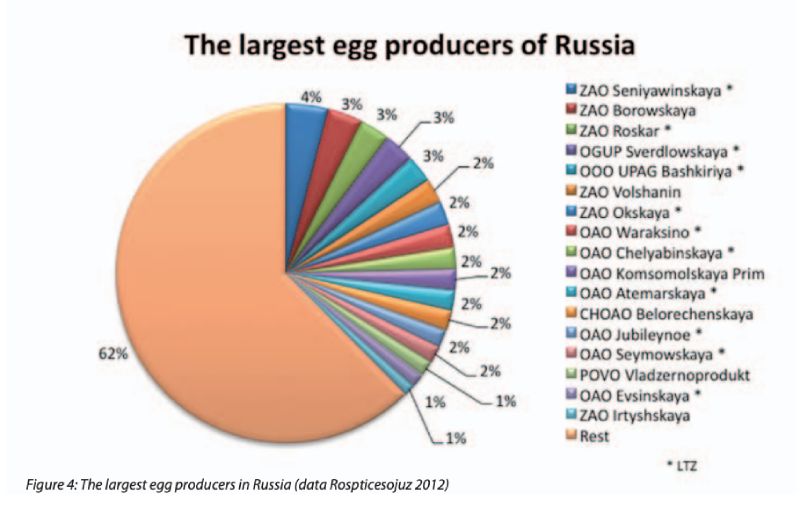

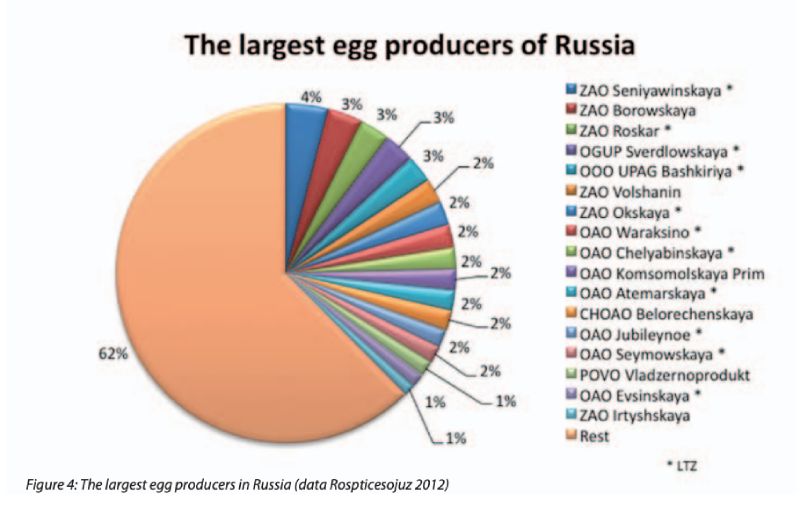

Through the increasing productivity and efficiency of LOHMANN TIERZUCHT’s laying hens and both of our leading breeds, the LSL-Classic and LB-Classic, we could constantly expand our market shares over the years despite stagnation in the market. The top results of our best customers (Sverdlowskaya PF – LTZ customer since 1995, Pyschminskaya PF – customer since 2001, Chelyabinsk PF – customer since 2001, Roskar – customer since 2004, Okskaya PF and Seniyawinskaya) have set benchmarks for the entire industry (Table 1). The strength of our hens is particularly noticeable in the following figure. Eleven of the 17 largest egg producing enterprises in Russia (11.2 of 32.7 billion eggs produced) keep LOHMANN TIERZUCHT laying hens (Total number of LOHMANN TIERZUCHT customers in Russia – 17) (Figure 4).

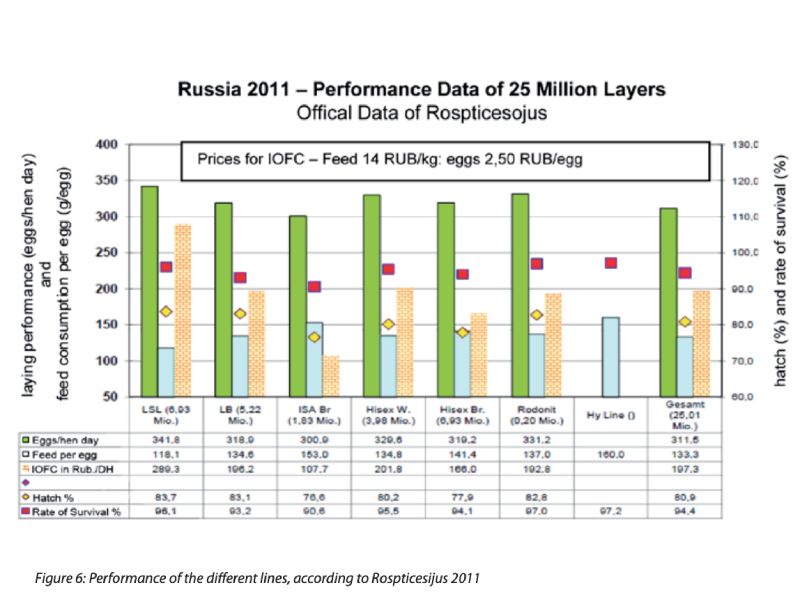

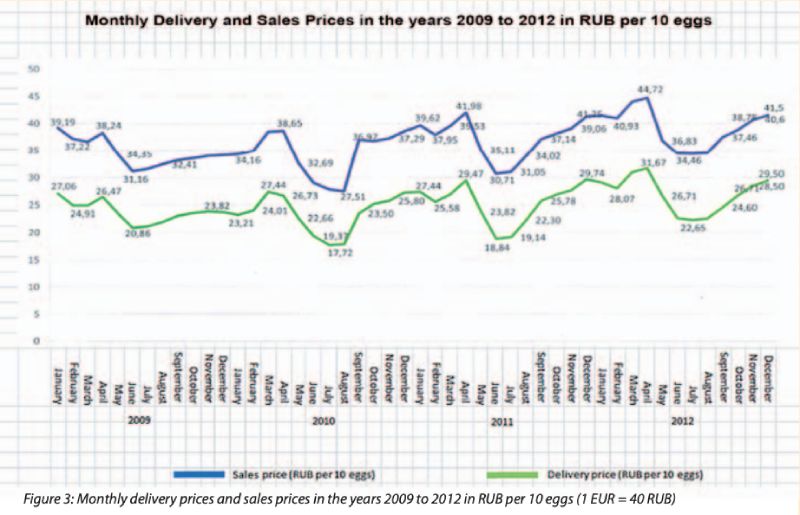

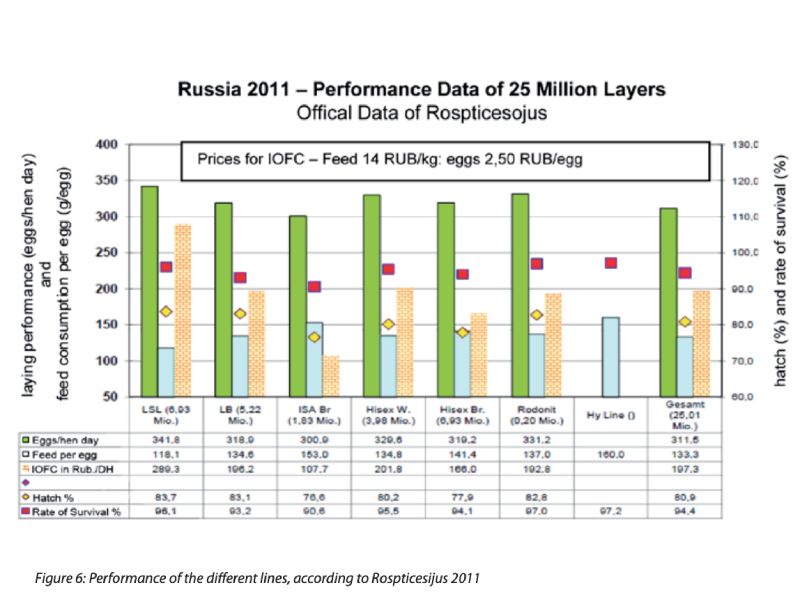

Due to a constant increase in performance (dia.1), very efficient feed consumption and a constantly increasing laying period, these poultry farms are also the most economically efficient ones (Figure 6, next page).

Today, almost 40 % of Russian eggs are produced by LOHMANN TIERZUCHT hens, with a rising trend.

Another major problem is the supply of chicks and / or pullets to small and medium poultry farms. In the past, i.e. until 1990, almost every poultry farm had its own parent stock flocks as well as an own hatchery. It was therefore possible to offer parent stock chicks from these breeding farms at a cheaper price.

The progressive reconstruction of the farms has resulted in an imbalance between the capacity of the facilities and the possibilities of the hatcheries. There is hardly a hatchery which can produce 50,000 – 80,000 chicks in one hatch. There are very often facilities which are able to handle such a capacity but since the main focus has been placed on the table egg market, there is hardly any interest to supply the free market with chicks or pullets. As a result of this, LOHMANN TIERZUCHT GMBH now places a great emphasis on the expansion of our franchise distributors.

There are already the first success stories such as in the franchise facilities in Kemerovo Inskaya PF which recently sold nearly 4 million chicks/ year, Vologodskiy Centr Pticewodstwa in Vologda – about 2.5 million chicks, Waraksino in Izhevsk – nearly 2 million chicks or Roskar, Pyshminskaya or Sverdlowskaya), which have been supplying the market.

With the inclusion of a layer operation, the farm Aleksandrowskiy in Ryasan, which is LTZ’s partner since 2005, the largest breeding farm in Russia, Okskaya was established.

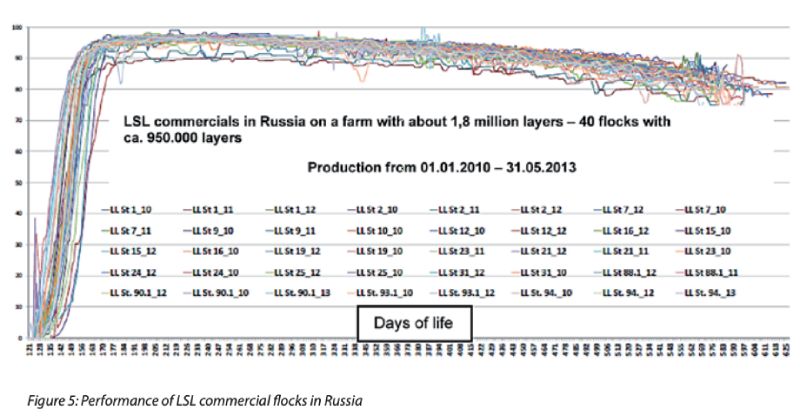

In 2011, they started keeping LOHMANN TIERZUCHT laying hens and in 2013, the largest and most unique hatchery in Russia was opened (Fig. 5). With the support of Pas Reform Technik, 15 million LOHMANN hens are produced here every year. The capacity can and should be doubled in a second phase. In order to utilize the hatchery’s full capacity of over 250,000, LSL and LB parents are being reared here. Thanks to modern transport technology, farms can be supplied with day-old chicks within a radius of about 2,000 km.

A major challenge remains in the expensive transportation of PS /GP chicks to Russia. Together with our customers, we are working on an appropriate solution.

Despite difficult market conditions, we still continue to see Russia as a very important growth market.

Norbert Mischke,

Area Sales & Service Manager

Okskay PF‘s PS Broodingfarm and PS housing

Development plans are often out of reach and despite tremendous growth in some regions, the past few years have shown stagnation in egg production. According to official figures, egg production is currently at about 42 billion eggs, of which just over 20 % (9.3 billion eggs) are produced in small house plants (Fig. 1, next page).

What seems to be quite unrealistic when compared to the rest of Europe, the per capita consumption of eggs lies at 297 eggs per year – a high level indeed. By 2020, this is expected to increase even more, i.e. up to 315 eggs per capita. However, if one looks at the actual development more closely, you will quickly discover that the increase in production takes place in only a few regions (Fig. 2).

In addition, it is striking that the largest increase is expected in regions that have limited feed resources, for example in Krasnojarskij Kraj Tumenskiy, Kemerowskiy and in the Nowosibirskiy region, which are in Siberia or in the Leningradskiy region (St. Petersburg) in the North. Southern regions of Russia and the Volga region, which have enormous reserves of feed, are rarely mentioned in the plans.

Like almost all countries of the world, Russia has huge problems with obtaining affordable raw feed materials. In recent years, grain was immediately exported after been harvested and poultry farms had to buy their feed at very high prices from distant regions. Raw materials that could be bought at relatively affordable prices, often did not meet the required quality. Grain from subsidized reserves of the country especially led to big problems due to their toxic load. Flocks which were affected due to the consumption of this feed displayed a deterioration in performance and also resulted in mortality. Despite rapid increases in feed prices from about RUB 4,000 per ton in 2008 –2009 and up to 12,000 –14,000 RUB/ton in May 2013 despite a relatively constant currency exchange rate of approximately RUB 40/EUR, egg prices remained constant, with the exception of seasonal fluctuations in the summer months. For years now, the delivery prices of the farms (Figure 3, green line) has been under RUB 30 per 10 eggs and the retailer sale price is at about RUB 40 per 10 eggs (Figure 3, blue line).

Through the increasing productivity and efficiency of LOHMANN TIERZUCHT’s laying hens and both of our leading breeds, the LSL-Classic and LB-Classic, we could constantly expand our market shares over the years despite stagnation in the market. The top results of our best customers (Sverdlowskaya PF – LTZ customer since 1995, Pyschminskaya PF – customer since 2001, Chelyabinsk PF – customer since 2001, Roskar – customer since 2004, Okskaya PF and Seniyawinskaya) have set benchmarks for the entire industry (Table 1). The strength of our hens is particularly noticeable in the following figure. Eleven of the 17 largest egg producing enterprises in Russia (11.2 of 32.7 billion eggs produced) keep LOHMANN TIERZUCHT laying hens (Total number of LOHMANN TIERZUCHT customers in Russia – 17) (Figure 4).

Due to a constant increase in performance (dia.1), very efficient feed consumption and a constantly increasing laying period, these poultry farms are also the most economically efficient ones (Figure 6, next page).

Today, almost 40 % of Russian eggs are produced by LOHMANN TIERZUCHT hens, with a rising trend.

Another major problem is the supply of chicks and / or pullets to small and medium poultry farms. In the past, i.e. until 1990, almost every poultry farm had its own parent stock flocks as well as an own hatchery. It was therefore possible to offer parent stock chicks from these breeding farms at a cheaper price.

The progressive reconstruction of the farms has resulted in an imbalance between the capacity of the facilities and the possibilities of the hatcheries. There is hardly a hatchery which can produce 50,000 – 80,000 chicks in one hatch. There are very often facilities which are able to handle such a capacity but since the main focus has been placed on the table egg market, there is hardly any interest to supply the free market with chicks or pullets. As a result of this, LOHMANN TIERZUCHT GMBH now places a great emphasis on the expansion of our franchise distributors.

There are already the first success stories such as in the franchise facilities in Kemerovo Inskaya PF which recently sold nearly 4 million chicks/ year, Vologodskiy Centr Pticewodstwa in Vologda – about 2.5 million chicks, Waraksino in Izhevsk – nearly 2 million chicks or Roskar, Pyshminskaya or Sverdlowskaya), which have been supplying the market.

With the inclusion of a layer operation, the farm Aleksandrowskiy in Ryasan, which is LTZ’s partner since 2005, the largest breeding farm in Russia, Okskaya was established.

In 2011, they started keeping LOHMANN TIERZUCHT laying hens and in 2013, the largest and most unique hatchery in Russia was opened (Fig. 5). With the support of Pas Reform Technik, 15 million LOHMANN hens are produced here every year. The capacity can and should be doubled in a second phase. In order to utilize the hatchery’s full capacity of over 250,000, LSL and LB parents are being reared here. Thanks to modern transport technology, farms can be supplied with day-old chicks within a radius of about 2,000 km.

A major challenge remains in the expensive transportation of PS /GP chicks to Russia. Together with our customers, we are working on an appropriate solution.

Despite difficult market conditions, we still continue to see Russia as a very important growth market.

Norbert Mischke,

Area Sales & Service Manager

Okskay PF‘s PS Broodingfarm and PS housing